Summary (TL;DR):

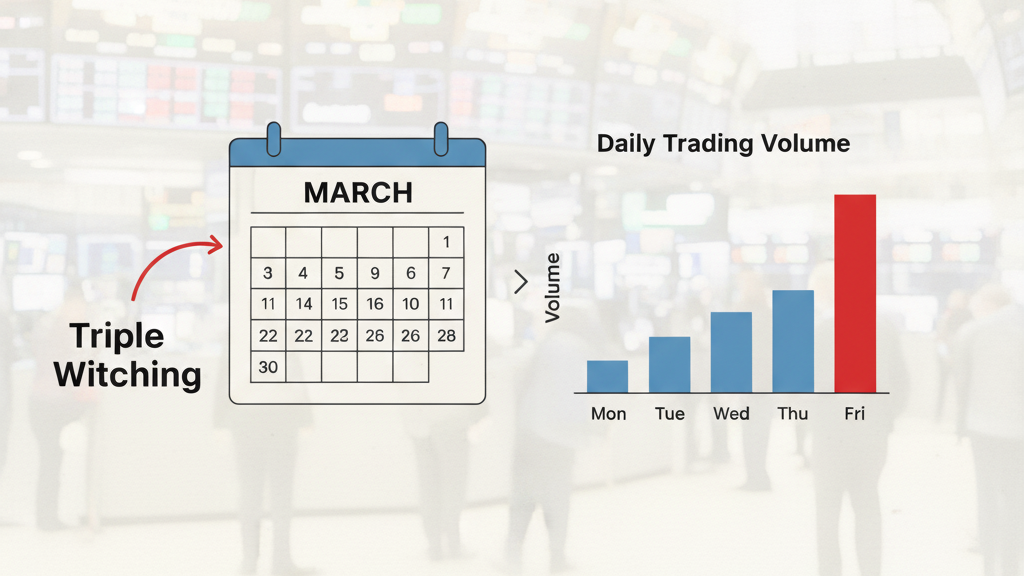

Triple Witching is a specific day that occurs four times a year when three types of financial contracts all expire on the same day. This simultaneous expiration forces a massive number of transactions to happen at once, leading to a temporary, but often dramatic, spike in trading volume and potential price volatility.

Introduction

Imagine a normally busy city intersection where, for a few minutes every few months, the traffic lights for all converging roads turn green simultaneously. The resulting flurry of activity would be intense, chaotic, and short-lived. In the world of finance, a similar event occurs four times a year. It is known as “Triple Witching,” a day when the market’s pulse quickens, its volume surges, and its movements can become unpredictable. For the prepared investor, understanding this event is not about predicting the chaos, but about recognizing it for what it is: a scheduled, temporary convergence of market forces.

A Look Back in Time

The term “Triple Witching” was coined in the 1980s by market analyst Robert Prechter. It wasn’t born from a single invention, but from the natural evolution of financial markets. As new types of investment products called derivatives were created—each with its own expiration date—it was inevitable that some of these dates would overlap. The third Friday of March, June, September, and December became the standardized point of convergence, creating a predictable flurry of activity as traders had to settle all of their expiring contracts before the market closed.

The Core Concept (Explained with Analogy)

Think of the stock market as a massive international airport hub. On a normal day, planes (trades) land and take off in an orderly fashion.

Now, imagine that on one specific Friday afternoon, the airport has scheduled the simultaneous arrival and departure of three of its largest and most complex international flights:

- A Fleet of Private Jets (Stock Options): These represent contracts on individual stocks. Many pilots must decide at the last minute whether to land (exercise their option) or divert (let it expire).

- A Jumbo Cargo Plane (Stock Index Futures): This represents a massive bet on the direction of the entire airport’s traffic (a whole market index like the S&P 500). Its landing is a huge, market-moving event.

- A Giant Passenger Airliner (Stock Index Options): Similar to the cargo plane, this represents another large contract on the direction of the entire market, but with different rules for its passengers.

On Triple Witching Friday, all three of these “flights” must conclude their journeys at the exact same time. This forces a frantic rush of activity in the final hour of trading. Pilots and portfolio managers must close out, roll over, or settle their positions. This concentrated need to trade creates huge spikes in volume and can cause sharp, temporary swings in the prices of both individual stocks and the market as a whole. Once the closing bell rings, the airport returns to its normal, orderly flow.

A Real-World Connection

During periods of high market stress, the effects of Triple Witching can be magnified. For instance, on the Triple Witching day of March 2020, amidst the intense volatility caused by the COVID-19 pandemic, the market experienced truly staggering trading volume. As traders scrambled to close or adjust their massive derivative positions in an already panicked market, the day’s price swings were amplified, showcasing how this scheduled event can pour fuel on an existing fire.

From Theory to Practice

For a beginner investor, the primary application of this knowledge is context. You are not likely trading these complex derivatives, but you will witness their effects. Understanding Triple Witching helps you answer important questions on these days:

- “Why did the market suddenly drop or surge in the last hour of trading?”

- “Is this huge trading volume a sign of a major new trend, or is it a temporary event?”

By knowing it’s a Triple Witching day, an investor can avoid overreacting to short-term volatility and refrain from making panicked decisions based on what is essentially a scheduled market traffic jam.

A Brief Illustration

Imagine it’s the third Friday in June. A trader, Sarah, holds options to buy shares of TechCorp at $150. The stock is trading at $155. Her options expire today, so she must act. At the same time, a massive pension fund holds S&P 500 futures contracts that also expire today, and they must close their position. Multiply Sarah and the pension fund by millions of other market participants, all forced to transact before the 4:00 PM EST closing bell, and you have the recipe for the surge in volume and price action that defines Triple Witching.

Key Takeaways

- Triple Witching occurs four times a year: on the third Friday of March, June, September, and December.

- It is the simultaneous expiration of three contract types: stock options, stock index futures, and stock index options.

- Its main effect is a significant increase in trading volume and the potential for increased volatility, especially in the last hour of trading.

- This is a temporary and predictable event. The market typically returns to normal trading patterns on the following Monday.

- For most long-term investors, it is an event to be aware of, not one to fear or necessarily act upon.

Chapter Glossary

- Derivatives: Financial contracts that get their value from an underlying asset, like a stock or an index.

- Stock Option: A contract giving the owner the right, but not the obligation, to buy or sell a stock at a specific price by a certain date.

- Stock Index Future: A contract obligating a party to buy or sell a financial index (e.g., the S&P 500) at a set price on a future date.

- Volatility: A measure of how quickly and dramatically a market’s price changes.

Food for Thought (Engagement Prompt)

- Now that you know what Triple Witching is, would you be more or less likely to make a trade on one of these days? Why?

- Does the existence of predictable events like this make the market seem more or less rational to you?

Further Your Learning

- Master Your Mind: Trading in the Zone by Mark Douglas

- Decode the Charts: Japanese Candlestick Charting Techniques by Steve Nison

- Learn from the Legends: Market Wizards by Jack D. Schwager