Summary (TL;DR)

VWAP and Moving Averages both aim to clarify price action, but they are fundamentally different tools. VWAP is an intraday anchor, weighted by volume, that resets every morning; it reveals the day’s “true” average price. Moving Averages are like a continuous river, weighted by time, that flows across days, weeks, or months; they reveal the direction of the longer-term trend. One is a benchmark for today’s execution, the other is a map of the ongoing journey.

VWAP and Moving Averages

In our related article, “Understanding the Volume-Weighted Average Price (VWAP),” we established the Volume-Weighted Average Price (VWAP) as a powerful lens for viewing intraday price action through the crucial context of volume. It answers the question, “Where did the market conduct its most significant business today?” However, many investors are more familiar with another, older tool for smoothing price data: the Moving Average (MA). While they may appear similar as lines drawn across a chart, their purposes are as different as a compass is to a stopwatch. To navigate the markets effectively, an investor must know not only how to use their tools, but also when to use them.

A Look Back in Time

The Moving Average is a classic pillar of technical analysis, with roots stretching back to a time when charts were drawn by hand. Early market technicians in the early 20th century, seeking to identify the primary direction of the market amidst daily volatility, would laboriously calculate average prices over weeks and months. The MA was born from a need to see the forest for the trees the underlying trend. In contrast, as we have learned, VWAP is a child of the modern electronic age, developed by institutions to solve the high-stakes, high-speed problem of executing enormous orders within a single trading day. One was designed for patient observation, the other for precise, immediate action.

The Core Concept (Explained with Analogy)

To grasp their distinct roles, imagine the price of a stock as a boat on a river.

The Moving Average is the river’s current. If you want to know the general direction the river is flowing, you observe its path over the last several miles. A 50-day moving average is like this; it tells you the broad, smoothed-out direction the price has been traveling over the past 50 days. It ignores the frantic paddling and minor eddies of any single day, focusing only on the powerful, overarching flow or trend.

The VWAP, on the other hand, is an anchor dropped at the dawn of a new day. The boat (the current price) is tethered to this anchor. It can drift away on gusts of wind (intraday volatility), but the anchor’s position, determined by the cumulative weight of all the day’s trading volume, exerts a conceptual pull. It provides a center of gravity for that day and that day alone. At the end of the day, the anchor is pulled up, and a new one is dropped when the market opens the next morning. The river’s current (the MA) flows on, oblivious to this daily ritual.

A Real-World Connection

Consider the market’s reaction to a scheduled Federal Reserve interest rate announcement on a day like Friday, October 3rd, 2025. A long-term investor holding shares of a utility company might primarily watch the 200-day moving average (MA). The violent price swings in the minutes after the 2:00 PM announcement would be of little concern; they are focused on whether this news ultimately alters the long-term uptrend, a change that would take days or weeks to be reflected in the 200-day MA.

Meanwhile, an institutional trading desk has a mandate to sell a one-million-share block of that same utility stock on that specific day. Their entire focus is on the VWAP. Before the announcement, they might sell small lots below VWAP. When the announcement sparks a massive spike in price and volume, the VWAP will shift dramatically. The desk’s algorithms will react in real-time, aiming to execute the remainder of their order at an average price above this newly established intraday benchmark, thereby proving their skillful execution to their client.

From Theory to Practice

Let’s dissect the fundamental differences:

- The Core Ingredient: The most critical distinction is the data they value. VWAP is calculated using Price and Volume. A $1 move on one million shares influences VWAP far more than a $1 move on one thousand shares. Moving Averages (like the SMA or EMA) use Price and Time only. They treat a $1 move on one million shares and a $1 move on one thousand shares as equally important to their calculation.

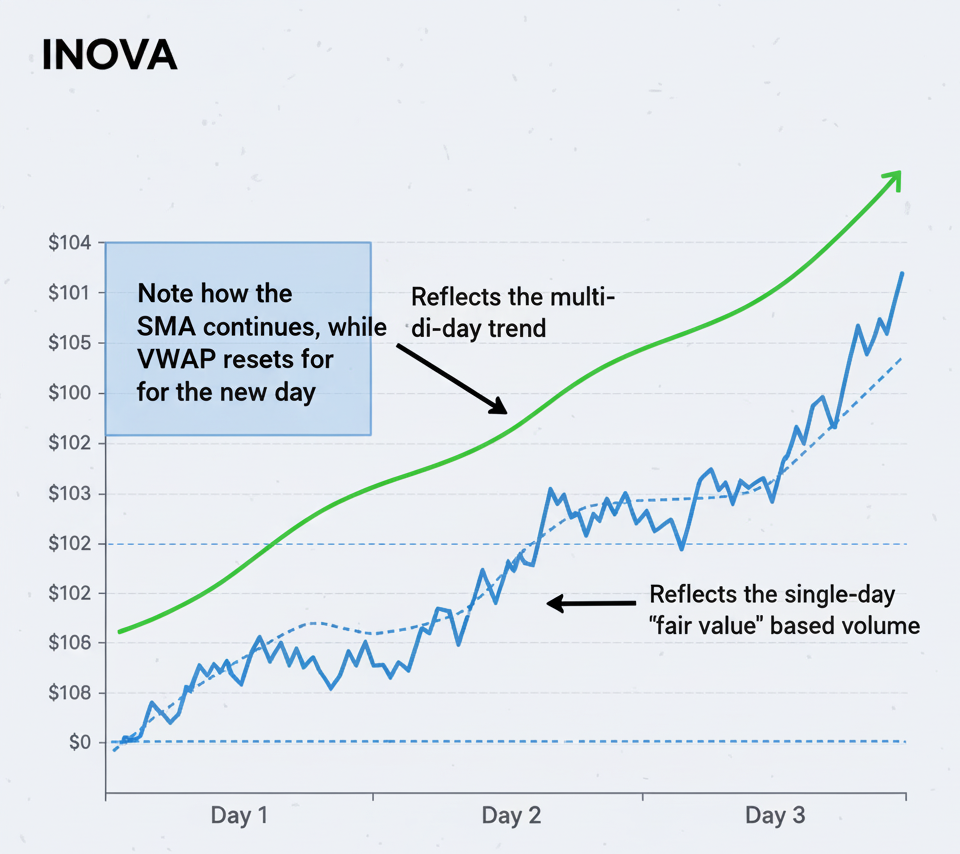

- The Time Horizon: VWAP is strictly an intraday indicator. Its calculation begins at the market open and ends at the close, resetting to zero every day. A Moving Average is a continuous, rolling calculation. A 20-day MA on a Tuesday is the average of the last 20 closing prices, and on Wednesday, it will drop the oldest day and add the new one, creating a seamless, flowing line.

- The Primary Purpose: VWAP’s main role is as a benchmark for trade execution. It helps traders assess the quality of their fills relative to the day’s average, volume-heavy price. MAs are primarily used for trend identification and to locate dynamic areas of support and resistance over a chosen period.

A Brief Illustration

Picture a stock chart at 9:31 AM, one minute after the market opens. You will see the first price print, and the VWAP line will be right there with it. However, a 50-day moving average line might be several dollars above or below the current price, because it represents the average closing price of the previous 50 days. As the trading day progresses, the VWAP will weave through the day’s price action, while the 50-day MA will appear almost stationary, moving only slightly based on the prior day’s close.

The Chapter’s Wisdom (Key Takeaways)

- Choose the Right Tool: Use VWAP for intraday analysis and trade evaluation. Use Moving Averages for analyzing trends over days, weeks, and months.

- Volume vs. Time: This is the essential difference. VWAP tells you what price is important based on activity. MAs tell you what the trend is based on history.

- Continuity Matters: The MA line is a continuous story told over many trading sessions. The VWAP line is a self-contained story of a single day.

- They Can Work Together: An intermediate strategy might involve waiting for the price to pull back to a rising 20-day MA (confirming the uptrend) and then using a move back above the intraday VWAP as a trigger for a long entry.

Chapter Glossary

- Moving Average (MA): An indicator that smooths out price data by creating a constantly updated average price over a specific time period.

- Simple Moving Average (SMA): The most basic type of MA, calculated by summing the closing prices from a period and dividing by the number of periods.

- Exponential Moving Average (EMA): A type of MA that gives more weight to the most recent prices, making it more responsive to new information than an SMA.

- Trend: The general direction in which a market or security’s price is moving over time.

- Intraday: Occurring within a single trading day.

Food for Thought (Engagement Prompt)

- If a stock is in a strong uptrend (trading far above its 50-day moving average), but for the past three days it has consistently failed to stay above its intraday VWAP, what might that conflict be signaling?

- Which indicator, VWAP or a 200-day MA, do you think would be more useful for a long-term retirement investor? Why?

Additional Topics to Explore

- Volume-Weighted Average Price (VWAP): Understanding the VWAP – The True Price of the Day

- Bollinger Bands: A Beginner’s Guide to Bollinger Bands – The River of Price.

- Relative Strength Index (RSI): Intro to the Relative Strength Index (RSI): The Engine’s Tachometer.

- RSI & Moving Averages: A System for Combining Moving Averages and RSI.