Morning Market Snapshot – October 15, 2025

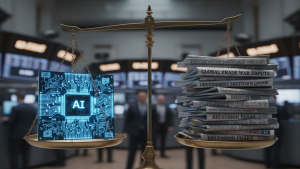

U.S. stock futures are pointing to a firmly positive open this Wednesday, as the market demonstrates a clear case of “selective hearing.” Investors are embracing a dovish signal from Federal Reserve Chair Jerome Powell, choosing to focus on the promise of future policy support while largely ignoring the chaotic, real-world costs of an escalating U.S.-China trade war.

As of 7:30 AM ET, S&P 500 futures are up 0.6%, with the tech-heavy Nasdaq 100 futures leading the way with a 0.8% gain. The market’s “fear gauge,” the VIX, is easing in response. The rally is being driven by Powell’s suggestion that the Fed is nearing the end of its balance sheet reduction (Quantitative Tightening), a move the market is interpreting as a green light to buy risk assets.

However, this optimism clashes with a messy reality. While the broad indices are rising on policy hopes, the trade conflict is causing explosive volatility in specific sectors, signaling that the real-world friction from tariffs and logistical disruptions has not gone away.

In the premarket, several individual names are making notable moves.

- Bank of America gained after posting higher advisory fees and better overall earnings than analysts projected.

- Australian Oilseeds (COOT): Shares of this agricultural biotech firm have surged a staggering 350% in pre-market trading. The explosive move is a direct reaction to President Trump’s threat to target the “Cooking Oil” trade with China, triggering massive speculative buying in alternative oilseed producers.

- Sadot Group (SDOT): Riding the same geopolitical wave as COOT, the agri-food company has seen its shares jump 147% as traders pile into the niche sector.

- Dollar Tree (DLTR) and BrightSpring Health Services (BTSG) are among the biggest risers in early trading, according to Barron’s.

- Critical Metals, a rare earths miner, is surging amid heightened U.S.–China trade tensions and renewed focus on strategic supply chains.

The Bull vs. Bear Debate

The Bull Case: The Fed’s Got Your Back Optimism is anchored in the belief that a dovish Fed provides a powerful backstop for stocks. Powell’s comments on ending QT have the market pricing in significant rate cuts by year-end. This liquidity, combined with the powerful secular growth story in Artificial Intelligencecredited by some with driving the vast majority of the market’s recent gains—creates a strong incentive for investors to buy any dips.

The Bear Case: Reality is Expensive Skeptics warn that renewed U.S.–China trade rhetoric—particularly around rare earths and technology exports—could quickly derail market momentum. The IMF also cautioned against market complacency, noting that valuations remain dangerously concentrated among mega-cap tech names. If those leaders falter this quarter, the broader market could face sharp downside pressure.

The Strategic Takeaway

This morning’s setup calls for balance rather than bold conviction. Strong corporate earnings lend support to the bullish narrative, but any flare-up in trade headlines could erase gains in an instant. The key for traders will be to watch for follow-through during the first hour of trading or signs of an early reversal.

Market Outlook

The tone heading into the opening bell appears cautiously optimistic, with a slightly bullish bias. Sustained follow-through will depend on whether upbeat earnings can overpower geopolitical noise.

Disclaimer: This article is for informational purposes only and does not constitute financial, investment, or legal advice. The information provided is a synthesis of publicly available data and expert analysis and should not be considered a recommendation to buy or sell any security. Investing in the stock market involves risk, including the possible loss of principal. Past performance is not indicative of future results. Readers should consult with a qualified financial advisor to determine an investment strategy that is suitable for their own personal financial situation and risk tolerance.

Sources