Closing Bell Market Brief

Last Updated: September 12, 2025

Closing Bell Recap:

The U.S. stock market ended a strong week with a mixed performance on Friday, as investors took a breath and positioned themselves ahead of the highly anticipated Federal Reserve meeting next week. The S&P 500 finished a volatile session nearly flat, down a marginal 0.05% to close at 6,584.29. The Dow Jones Industrial Average saw a more decisive move lower, shedding 273.78 points, or 0.59%, to end the day at 45,834.22. In contrast, the tech-heavy NASDAQ Composite continued its upward trend, gaining 98.03 points, or 0.44%, to close at a new record high of 22,141.10.

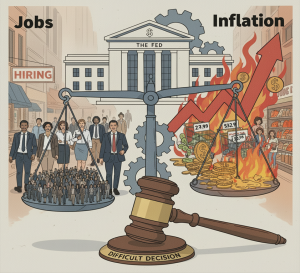

The dominant theme of the trading day was a palpable sense of anticipation for the Federal Reserve’s upcoming interest rate decision. While recent data has shown a cooling labor market, a “sticky” Consumer Price Index (CPI) report earlier in the week has left some investors questioning the central bank’s path. Nevertheless, the prevailing sentiment is that a rate cut is imminent, which has been a primary driver of the market’s recent rally. Corporate-specific news also played a significant role in today’s trading, with major M&A speculation and key earnings reports creating pockets of significant volatility.

Why it Matters

For investors, this week’s market action underscores a critical juncture. The Federal Reserve’s forthcoming decision on interest rates is poised to be a major catalyst, likely setting the tone for the market’s direction in the coming weeks. A rate cut could further fuel the ongoing rally, particularly in growth-oriented sectors like technology. However, any indication from the Fed that they are hesitant to ease monetary policy due to persistent inflation could lead to a swift market pullback.

The divergence between the tech-focused NASDAQ and the broader S&P 500 and Dow also highlights a market that is being selective, favoring companies with strong earnings and growth prospects while punishing those that show signs of weakness. Investors should be prepared for increased volatility as the market digests the Fed’s commentary and re-evaluates the economic landscape.

Key Market Drivers:

- Federal Reserve Rate Cut Anticipation: The market is overwhelmingly pricing in the first interest rate cut of the year at the Fed’s meeting next week, which has been a primary catalyst for the recent upward momentum.

- Inflation and Economic Data: A recent “sticky” CPI report has been a point of concern, but signs of a cooling labor market are giving the Federal Reserve cover to potentially lower rates.

- Merger and Acquisition Buzz: Reports of a potential takeover bid for Warner Bros. Discovery by Paramount Skydance sent shockwaves through the media sector, highlighting the potential for significant consolidation.

- Corporate Earnings Reports: Strong earnings from Adobe, driven by its AI initiatives, boosted the tech sector, while a disappointing report from luxury furniture retailer RH weighed on consumer discretionary stocks.

Post-Market Movers

Trading Higher

- Warner Bros. (WBD):

- Reason for Change: Reports emerged that Paramount Skydance is preparing a majority cash offer to acquire Warner Bros. Discovery, causing the company’s stock to jump significantly on high trading volume. The potential deal is seen as a major consolidation move in the media industry.

- Tesla (TSLA)

- Reason for Change: As part of a wider market rally, Tesla shares moved higher on growing investor optimism that the Federal Reserve will cut interest rates. The prospect of lower borrowing costs is seen as beneficial for growth stocks and consumer demand for big-ticket items like electric vehicles.

Trading Lower

- Opendoor (OPEN):

- Reason for Change: Shares of technology real estate company Opendoor OPEN fell 9.7% in the morning session after it pulled back from a recent massive rally that was reportedly driven by investor activity on social media rather than fundamental business news.

- Stanley Black & Decker, Inc. (SWK):

- Market Capitalization: Approximately $16.78 Billion

- After-Hours Price: $77.21

- Change: -$2.31 (-2.90%)

- Reason for Change: Concerns over the company’s recent earnings report which, despite beating profit forecasts, fell short on revenue.

- Celanese Corporation (CE):

- Market Capitalization: Approximately $5.10 Billion

- After-Hours Price: $45.67

- Change: -$1.20 (-2.56%)

- Reason for Change: A recent lowering of the company’s stock price target by Jefferies, citing a delayed cyclical recovery.

Next Session Outlook

Directional Bias: Neutral to Slightly Bullish

- Sectors in Focus:

- Financials: This sector will be in the spotlight as the market anticipates the Federal Reserve’s interest rate decision, which directly impacts bank profitability.

- Technology: With the NASDAQ showing strong momentum, technology stocks, particularly those with a strong AI narrative, will continue to be a focus.

- Pre-Market Catalyst to Watch: The release of the NY Empire State Manufacturing Index at 8:30 AM EDT on Monday, September 15th, will provide an early read on the health of the manufacturing sector.

- Confidence Level: Medium – While the market has a positive bias heading into the Federal Reserve meeting, there is a significant risk of a reversal if the Fed’s statement and projections are more hawkish than expected.

Disclaimer: This article is for informational purposes only and does not constitute financial, investment, or legal advice. The information provided is a synthesis of publicly available data and expert analysis and should not be considered a recommendation to buy or sell any security. Investing in the stock market involves risk, including the possible loss of principal. Past performance is not indicative of future results. Readers should consult with a qualified financial advisor to determine an investment strategy that is suitable for their own personal financial situation and risk tolerance.