Summary (TL;DR)

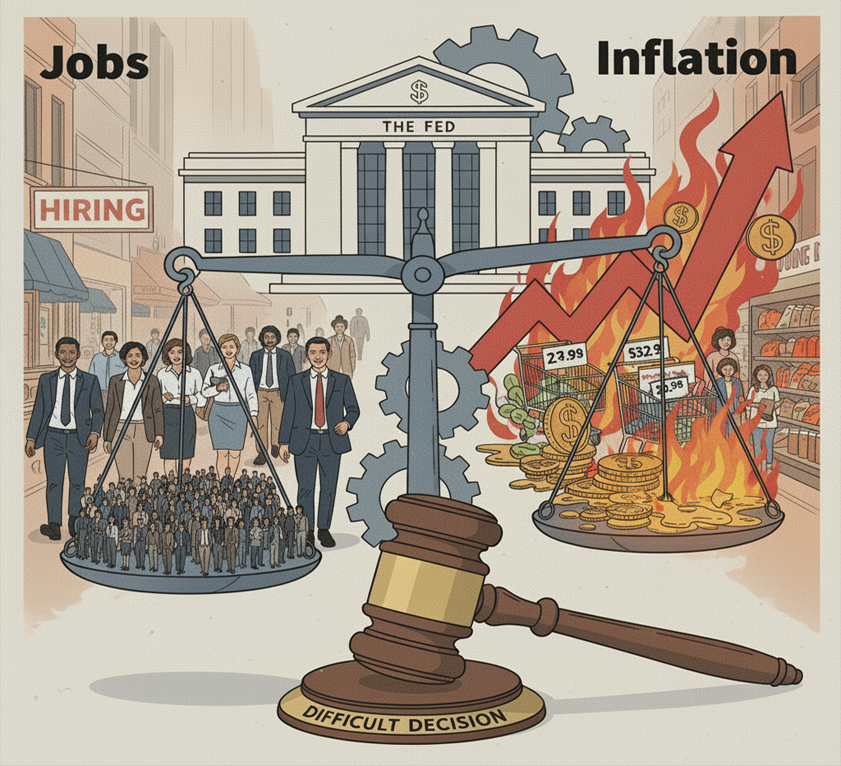

For investors, the key takeaway from this week’s news is that the Federal Reserve is now almost sure to cut interest rates at its upcoming meeting next week. This development is significant because it marks a major policy shift after a long pause, driven by growing concerns that the U.S. jobs market is weakening. While a rate cut is typically seen as a positive for the stock market, the optimism is tempered by inflation that remains stubbornly above the Federal Reserve’s target, creating a complex and uncertain economic picture.

The Core News (What Happened?)

Recent economic data has solidified expectations for the Federal Reserve’s first interest rate cut of the year. Reports from the last few days showed that inflation in August rose to its highest level since January, with consumer prices up 2.9% from a year ago. At the same time, the labor market showed clear signs of softening, as weekly applications for unemployment benefits surged to their highest point in nearly four years. Despite the high inflation, the weakening job data has convinced markets and economists that the Fed will prioritize supporting employment and cut its benchmark interest rate, likely by a quarter of a percentage point (0.25%), at its policy meeting on September 16-17.

Background (Setting the Stage)

Coming into this week, investors and analysts were already leaning heavily towards the expectation of a rate cut. Throughout 2025, the Fed had kept interest rates on hold, citing concerns that tariffs could push prices higher. However, recent speeches from Fed officials, including Chair Jerome Powell, had signaled a growing concern over “downside risks to employment.” The latest reports on rising jobless claims and slowing hiring have cemented this view, shifting the debate from if the Fed will cut to by how much and for how long. The market is now pricing in over a 90% probability of a September cut, a significant increase in certainty compared to just a few weeks ago.

The Debate (The Bull vs. Bear Case)

The Bull Case (The Optimistic View): On one hand, optimists believe this rate cut is a necessary and timely move to support the economy. Proponents of this view, as highlighted in reports from AP News and The Economic Times, argue that the weakening labor market is a more significant threat than the current level of inflation. They believe the Fed is correctly shifting its focus to prevent a potential recession. A rate cut would lower borrowing costs for consumers and businesses, potentially stimulating spending and investment, which could extend the stock market rally and keep the economy growing. As economist Kathy Bostjancic noted, the labor market’s loss of steam “reinforces that the Fed needs to start cutting rates next week and that it will be the start of a series of rate reductions.”

The Bear Case (The Cautious View): On the other hand, cautious voices point to the unusual and risky situation the Fed is in. A report from The Washington Post raises concerns about the specter of “stagflation”, a toxic mix of slow economic growth, high unemployment, and rising inflation. Cutting rates when inflation is already above the Fed’s 2% target is a gamble. Critics, cited in various analyses, worry that this could fuel further price increases, hurting consumers’ purchasing power. Furthermore, there is concern that the Fed is cutting rates in response to political pressure, which could undermine its credibility as an independent inflation-fighter in the long run. This camp sees the Fed as being caught in a tricky balancing act with no easy answer.

By the Numbers (Key Data & Metrics)

- Consumer Price Index (CPI): Rose to 2.9% annually in August. (This is a key measure of inflation, showing how much the average price of goods and services has increased.)

- Core CPI: Stood at 3.1% annually in August. (This is inflation excluding the volatile categories of food and energy, giving a clearer view of underlying price trends.)

- Weekly Jobless Claims: Jumped to 263,000 last week. (This shows the number of people filing for unemployment for the first time, indicating a potential rise in layoffs.)

- Market-Implied Probability of a Rate Cut: Over 93% for the September meeting. (This is based on futures market trading and reflects investors’ collective bet on what the Fed will do.)

- Current Fed Funds Rate Target: 4.25% to 4.50%. (This is the benchmark interest rate that the Fed is expected to lower.)

Disclaimer: This article is for informational purposes only and does not constitute financial, investment, or legal advice. The information provided is a synthesis of publicly available data and expert analysis and should not be considered a recommendation to buy or sell any security. Investing in the stock market involves risk, including the possible loss of principal. Past performance is not indicative of future results. Readers should consult with a qualified financial advisor to determine an investment strategy that is suitable for their own personal financial situation and risk tolerance.