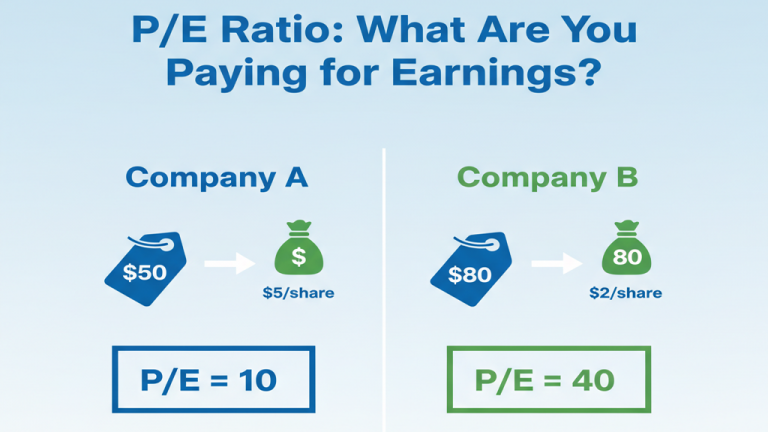

The Price-to-Earnings (P/E) ratio is a simple valuation metric that tells you how expensive a company's stock is relative to…

Mastering Dollar-Cost Averaging (DCA) – The Investor’s Rhythm

Dollar-Cost Averaging (DCA) is the disciplined strategy of investing a fixed amount of money at regular intervals—for example, $100 every…

Market at a Record High? Don’t Panic. Here’s What History Says To Do Next.

Examining the markets, we see this unfolding in real time. Indices like the S&P 500 are charting new territory, pushing…

Inflation vs. Interest Rates: Can the Federal Reserve Win its Balancing Act?

For investors, the key takeaway from today's market activity is that optimism about the Federal Reserve's willingness to cut interest…

The Market’s Hour of Power: Understanding Triple Witching

Triple Witching is a specific day that occurs four times a year when three types of financial contracts all expire…

US-China Trade Talks in Focus as Wall Street Navigates Record Highs

U.S. stock futures are holding steady near the record highs achieved in the previous session, indicating a cautious optimism among…

What the Nvidia-Intel AI Deal Means for the Stock Market

For investors, the key takeaway from today's trading is that enthusiasm for artificial intelligence, supercharged by a landmark deal between…

Bull vs. Bear: Two Ways to See the Federal Reserve’s September Rate Cut

For investors, the key takeaway from the Federal Reserve's announcement today is that the central bank has officially shifted its…

Federal Reserve & interest rate cut: Cut Sparks Pre-Market Rally; Inflation Caution Lingers

The top story overnight is the Federal Reserve's decision to cut its benchmark interest rate by a quarter-percentage point, the…

What the Fed’s First Rate Cut of 2025 Means for Your Investments

For investors, the key takeaway from today's trading is that the Federal Reserve has begun to ease its monetary policy…