For investors, the key takeaway from this news is that Nvidia's upcoming earnings report has effectively become a referendum on…

What Elon Musk’s $1 Trillion Pay Package Means for Tesla Investors

For investors, the key takeaway from this week's news is that Tesla shareholders have overwhelmingly bet on Elon Musk, and…

The Longest Government Shutdown in U.S. History: When Will It Finally End?

The United States is deep into the longest government shutdown in its history, and while there are glimmers of hope…

ADP Report: U.S. Private-Sector Jobs Up 42,000 in October, A Modest Rebound

The ADP Research Institute monthly employment report, released today (Nov 5, 2025), shows that U.S. private-sector employers added 42,000 jobs…

Is the Government Shutdown a Buying Opportunity for Investors?

For investors, the key takeaway from the looming US government shutdown is that while it may create short-term market choppiness,…

What Does CoreWeave’s $22.4 Billion OpenAI Deal Mean for Your AI Stocks?

For investors, the key takeaway from the firestorm of recent CoreWeave news is its rapid solidification as a critical player…

Opendoor Stock: A Founder’s Fiery Return Sparks a Market Frenzy

For investors, the key takeaway from the whirlwind of news surrounding Opendoor (OPEN) this week is a radical leadership overhaul…

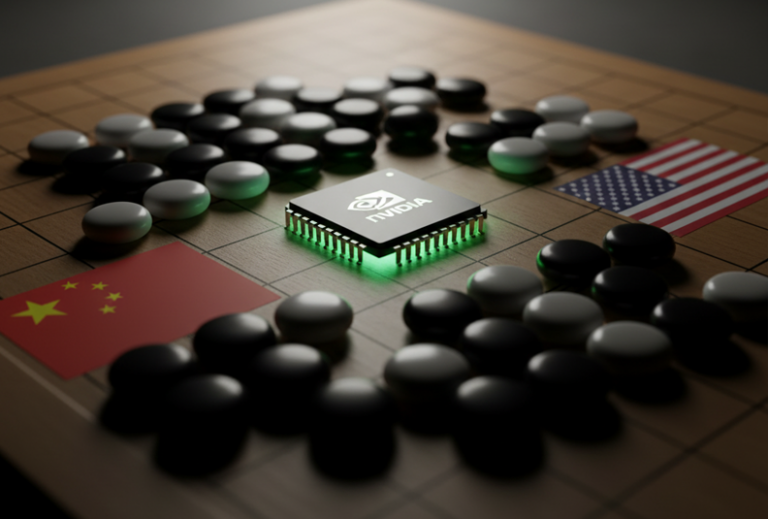

China Tells Tech Giants to Stop Buying NVIDIA Chips: What It Means for Investors

For investors, the key takeaway from the latest NVIDIA news is the direct and escalating impact of U.S.-China geopolitical tensions…

Why Wall Street is Turning More Bullish on Workday (WDAY) Stock

For investors, the key takeaway is that Workday's stock is trading higher due to a wave of positive analyst reactions…

“Hawkish Cut”: Why the Fed’s Best Move Could Be the Market’s Biggest Fear

A high-stakes calm has settled over Wall Street, but don't mistake it for peace. With the Nasdaq roaring at all-time…