Summary (TL;DR)

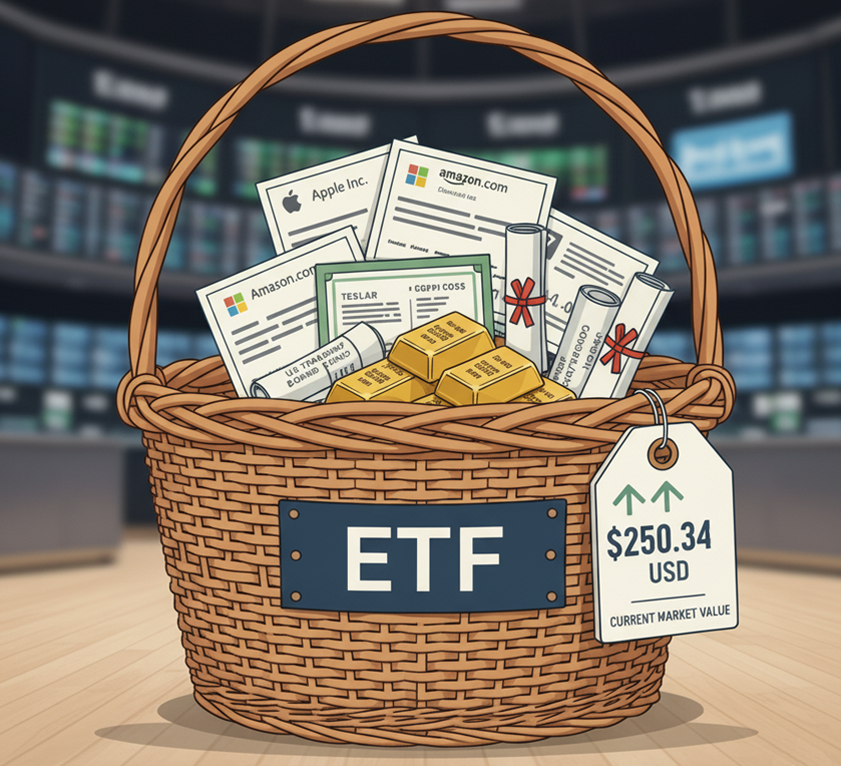

An Exchange-Traded Fund, or ETF, is a type of investment fund that holds a collection of assets, like stocks, bonds, or commodities, and is traded on a stock exchange, just like a single stock.

Introduction

Imagine a vast and bountiful market. You could spend all day meticulously picking out individual fruits and vegetables, weighing each one, and paying for them separately. Or, you could simply grab a pre-packaged basket filled with a diverse, healthy assortment of produce. This second option, the curated basket, is the essence of an ETF. It offers a simple, efficient way to buy a variety of investments at once, giving you a taste of diversification without the effort of selecting each asset yourself.

A Look Back in Time

The concept of a fund that mirrors a market index dates back to the 1970s, but the first true ETF as we know it today was created in 1993. The “Standard & Poor’s Depositary Receipts” or SPDRs (often called “Spiders”), were designed to track the S&P 500 index. This innovation democratized investing, allowing everyday people to own a piece of the entire market in a single transaction, something previously only accessible to large institutions.

The Core Concept (Explained with Analogy)

Think of an ETF as a pre-assembled investment basket. Instead of containing fruits and vegetables, this basket holds a variety of investment securities, stocks from a hundred different companies, perhaps, or a collection of government bonds. When you buy a share of an ETF, you are not buying a single stock; you are buying a tiny slice of that entire basket.

This basket is created and managed by a financial firm. The firm’s job is to ensure the contents of the basket accurately reflect a specific investment theme or market index. For example, an ETF designed to track the S&P 500 would contain shares of the 500 companies in that index, in the correct proportions. As the value of those companies’ stocks changes, the value of the entire basket and thus the price of one share of the ETF changes with it.

A Real-World Connection

The rise of technology in the late 1990s and early 2000s saw the creation of ETFs focused on the burgeoning tech sector. An investor who believed in the future of technology could simply buy a single share of a tech-focused ETF, rather than having to choose which specific tech companies would succeed. This streamlined approach allowed many to participate in the tech boom with a single, diversified trade.

From Theory to Practice

Investors apply the ETF concept to answer a critical question: “How can I get broad exposure to a market without the risk and cost of buying every single security?” By purchasing an ETF, an investor can:

- Diversify instantly: A single purchase spreads risk across many companies or assets.

- Access specific sectors: Buy an ETF that tracks a certain industry, like healthcare or clean energy.

- Keep costs low: ETFs often have lower expense ratios than traditional mutual funds.

- Trade with ease: They can be bought and sold throughout the trading day, unlike mutual funds which are priced only at the end of the day.

A Brief Illustration

An investor wants to own a piece of the entire U.S. stock market. Instead of buying individual shares of all 500 companies in the S&P 500, they could buy a single share of an ETF that tracks that index. If the S&P 500 index goes up by 1%, the value of their ETF share will also go up by approximately 1%.

Key Takeaways

- ETFs are diversified baskets of investments.

- They trade on stock exchanges like individual stocks.

- They offer a low-cost and efficient way to gain exposure to different markets or sectors.

Chapter Glossary

- Diversification: The practice of spreading investments across a range of assets to reduce risk.

- Index: A statistical measure of the changes in a portfolio of stocks, bonds, or other securities, representing a market or a segment of a market.

- Expense Ratio: The annual fee charged by a fund to cover its operating and management expenses.

Additional Topics to Explore

- Market Breadth: Understanding Market Breadth: The Army and Its Generals.

- Understanding Support and Resistance: The Market’s Memory: Understanding Support and Resistance

- Limit Orders: The order type that a stop-limit becomes once it is triggered.