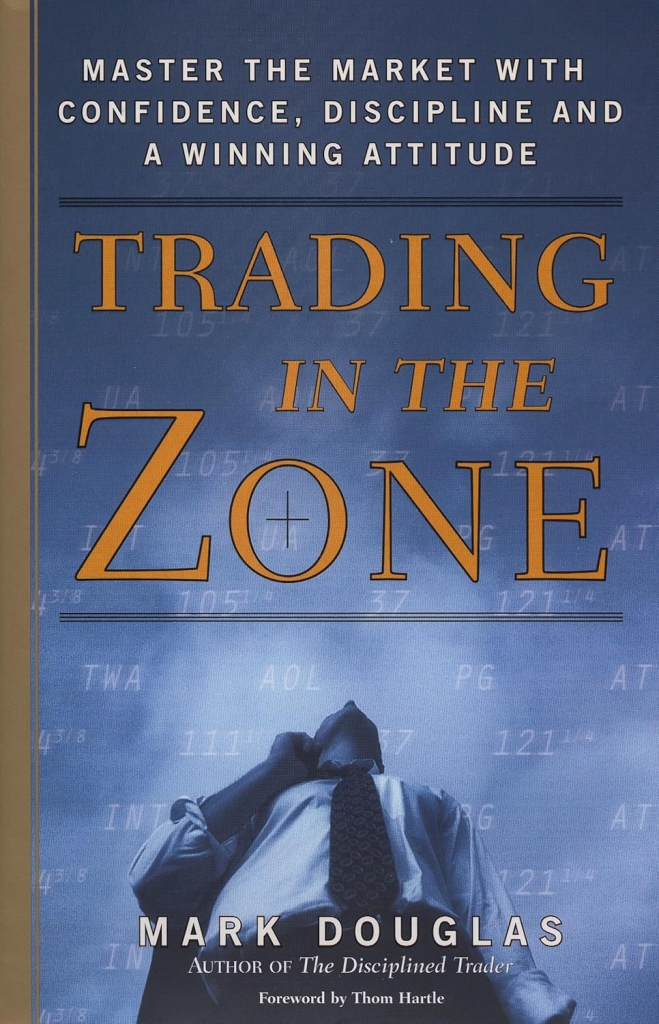

Trading in the Zone: The Mindset Upgrade That Turns Good Ideas Into Consistent Profits

Suppose you have a solid trading strategy but struggle with consistent execution, hesitating on entries, chasing trades, or letting emotions dictate your decisions. In that case, Mark Douglas’s Trading in the Zone is the essential guide you need. This book doesn’t offer a new trading system; it offers a profound reset for the most important variable in your success: your mindset.

Douglas argues that the market is neutral and free of judgment. It’s our own human emotions—specifically fear and greed—that cause us to make irrational mistakes and lose money. The book’s core value lies in teaching you how to overcome these emotional hurdles by adopting the psychology of a professional trader.

The Psychology of Probabilistic Thinking: Thinking Like a Casino

The central message of Trading in the Zone is the need to embrace a probabilistic mindset.

Imagine a casino. The casino doesn’t know who will win or lose on a single hand of blackjack. They operate with the certainty that, over a vast number of hands, the odds are slightly in their favor. They don’t get emotional about individual wins or losses; they simply follow their system and trust the probabilities.

A successful trader must learn to think the same way. The book teaches you to stop viewing each trade as a singular win or loss and start seeing it as just another event in a long series. A winning trade doesn’t mean you’re a genius, and a losing trade doesn’t mean you’re a failure. They are simply the outcomes of a valid trading edge. This shift in perspective allows you to remain calm and objective, regardless of the immediate result.

From Theory to Practice: Flawless Execution Discipline

Adopting a probabilistic mindset is the first step; flawless execution is its practical application. The book emphasizes the critical importance of following your trading plan without hesitation or emotional interference.

What this means in practice:

- Pre-accept Risk: Decide on your position size and stop-loss before you enter a trade so your emotions can’t negotiate with you mid-trade.

- Sample-Size Thinking: Judge your performance over a series of 20-30 trades, not on the outcome of a single one. This eliminates the need to be “right” on every trade.

- No-Exception Rules: If your checklist says “enter,” you enter. Your stop and target are not suggestions—they are mandatory.

- Belief Audit: Reframe your thinking from “losses equal failure” to “losses are a business cost.” This simple shift can make revenge trading—trying to win back losses—vanish.

The biggest hurdle Douglas identifies is the fear of being wrong or losing money. This fear is what causes you to hesitate on a valid entry, cut a winner too early, or let a small loss turn into a big one. Trading in the Zone provides a clear framework and mental exercises to help you build the discipline needed to trust your system and execute with confidence.

Why This Book Matters: A Powerful Mini-Framework

This isn’t a magic system, but a mental model that allows your existing system to finally pay you. For traders who have decent analysis but inconsistent execution, this book provides a powerful three-step framework:

- Create a concise checklist for your trading edge (context, signal, entry, stop, target).

- Risk a fixed amount that is emotionally trivial to you.

- Take 20 trades with zero rule changes, scoring yourself only on your adherence to the rules, not your profit and loss (P&L).

The results of this disciplined approach are not flashy, but they are consistently powerful. You get a clear mental model for probabilistic thinking and practical scripts for handling the common fears that cripple traders: being wrong, losing money, missing out, and leaving money on the table.

Bottom Line

Trading in the Zone is a cornerstone for any serious trader because it addresses self-mastery. It teaches you to take full responsibility for your results by understanding that your mindset and execution—not market volatility—are the primary determinants of your success. If your edge is “fine” but your behavior isn’t, this book will likely pay for itself in a single disciplined trade.

Reader Impressions: Join the Discussion

If you’ve read Trading in the Zone, we’d love to hear your thoughts. Share your experience in the comments below!

- What was your biggest “A-ha!” moment while reading this book?

- Did any of the concepts, like “probabilistic thinking,” feel counter-intuitive or difficult to accept at first?

- How did this book change the way you looked at your own trading results (both wins and losses)?

- Can you think of a specific time when you used a lesson from this book to overcome an emotional trading mistake?