Summary

OTC (Over-the-Counter) trading is a decentralized way of buying and selling financial instruments directly between two parties, bypassing a formal, centralized exchange like the New York Stock Exchange. It is a private marketplace where terms are often negotiated through a network of dealers rather than a public auction.

Introduction

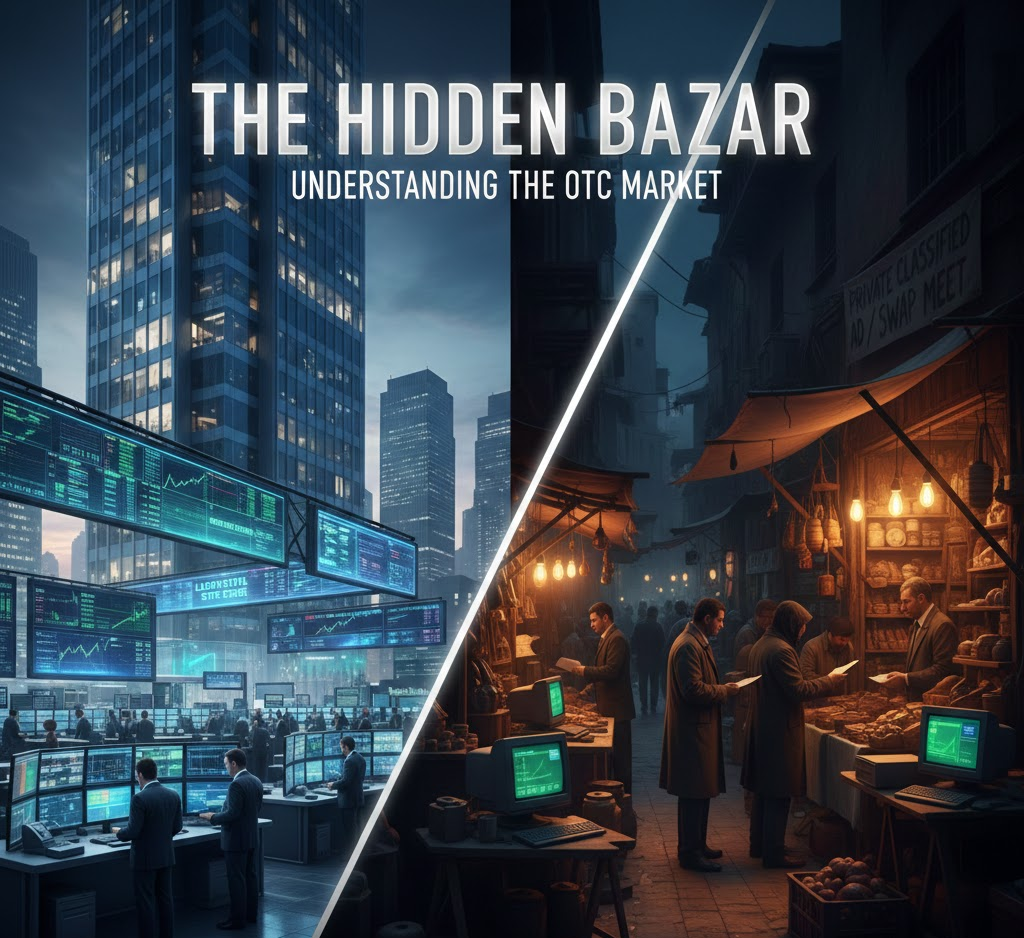

In the grand architecture of finance, we often visualize the “Market” as a great, glass-walled skyscraper—the Central Exchange, where every trade is witnessed, every price is public, and strict rules govern who can enter. However, there exists a second, equally vital world: the Over-the-Counter (OTC) market. It is the “hidden bazaar” of the financial world, where transactions happen away from the bright lights of the exchange floor. Understanding the OTC is essential because it is where the world’s most flexible, and sometimes most volatile, trading occurs.

The Core Concept (Explained Simply)

To understand the difference between an Exchange and the OTC, imagine you want to buy a high-end bicycle.

If you go to a Centralized Exchange, it is like visiting a Luxury Retail Store. The store has a fixed price on the tag, a set of rules for returns, and every customer sees the same price. You know the bike has passed safety inspections because the store won’t sell anything that doesn’t meet their high standards.

OTC Trading, by contrast, is like buying a bicycle through a Private Classified Ad or a Local Swap Meet. There is no central building. Instead, you call or message different sellers (dealers) to see what they have and what price they’ll give you. You might negotiate the price or the terms of the sale. Because there is no “store manager” enforcing strict rules, you can find unique, custom bikes that a retail store wouldn’t carry, but you also bear the responsibility of checking the “brakes” yourself, as there is less formal oversight.

In the financial OTC market, instead of a physical floor, there is a vast web of computers and telephones connecting banks and dealers. They trade things that aren’t “listed” on the big exchanges, such as small-company stocks (Penny Stocks), corporate bonds, or complex custom contracts (Derivatives).

From Theory to Practice

Traders use the OTC market for several specific strategic reasons:

- Accessing “Unlisted” Companies: Many small or emerging companies cannot afford or do not meet the strict requirements of a major exchange. Investors looking for “the next big thing” often hunt in the OTC markets (such as the Pink Sheets).

- Customization: Large institutions use the OTC to create “bespoke” deals. For example, a company might want a hedge against a very specific currency fluctuation that doesn’t exist as a standard contract on an exchange.

- Foreign Markets: Many massive international brands (like Nintendo or Adidas) trade in the U.S. via the OTC market as “ADRs” to avoid the regulatory burden of a full U.S. exchange listing.

- What to look for: On a chart, OTC stocks often show “gaps” and low volume. Because there are fewer buyers and sellers, the Bid-Ask Spread (the gap between the buy and sell price) is usually much wider than on a major exchange.

A Brief Illustration

Imagine a small biotech startup, “CureCo,” that has a promising new patent but doesn’t have the $100 million in revenue required to list on the NASDAQ. Instead, CureCo lists its shares on an OTC network. A trader interested in CureCo doesn’t place an order on a public exchange. Instead, their broker contacts a “Market Maker” who holds CureCo shares. They agree on a price privately, and the trade is executed. The trader gets the shares, but they accept the risk that because the stock is “thinly traded,” it might be harder to sell them quickly later on.

Why It Matters

- Flexibility: It allows for the trading of assets that don’t fit the “one-size-fits-all” mold of major exchanges.

- Higher Risk/Reward: It is the home of “Penny Stocks,” offering the potential for massive gains but also a high risk of total loss or fraud.

- Liquidity Warnings: Because it’s a private bazaar, you might find that when you want to sell, there are no “shoppers” in the market that day, forcing you to accept a lower price.

Additional Topics to Explore

- Understanding Liquidity The Market’s River: Understanding Liquidity

- Market Breadth: Understanding Market Breadth: The Army and Its Generals

- Understanding Liquidity The Market’s River: Understanding Liquidity