Closing Bell October 15, 2025

Summary (TL;DR)

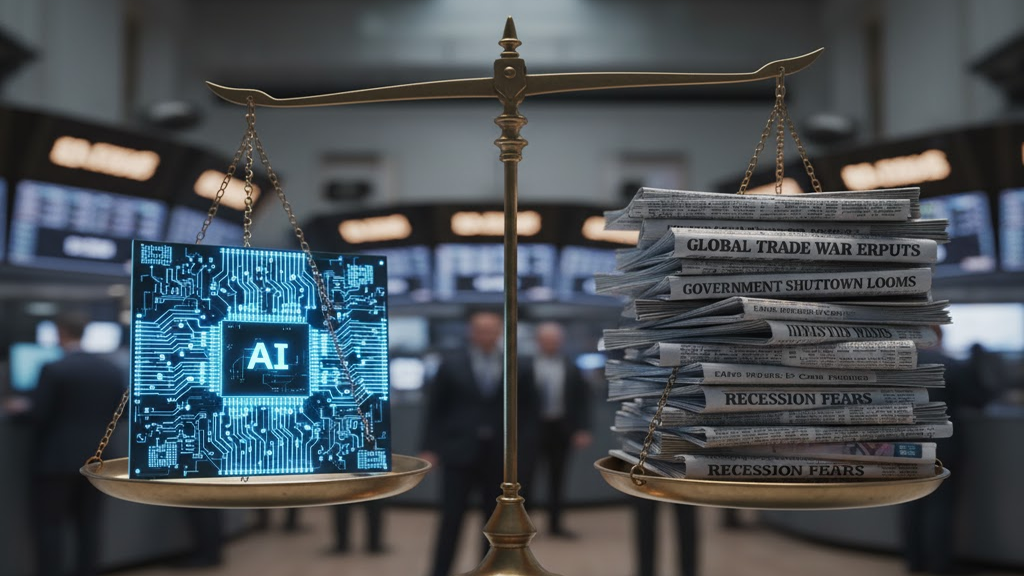

For investors, the key takeaway from today’s volatile session is that corporate earnings and the unstoppable momentum of Artificial Intelligence (AI) investment are currently outweighing the macroeconomic uncertainty from geopolitical trade tensions and the ongoing U.S. government shutdown. The tech-heavy Nasdaq and the S&P 500 managed to close higher, driven by powerful gains in the semiconductor sector following an upbeat outlook from major chip equipment maker ASML and strong quarterly results from major banks like Bank of America and Morgan Stanley. The market is in a “tug-of-war” where positive company specific news is giving investors’ confidence to buy, despite a lack of critical government economic data (like the delayed inflation report) and persistent US-China trade tensions that created intraday swings.

What Happened?

U.S. stock markets finished a volatile trading day mixed but generally higher, driven by strong corporate earnings and a rally in semiconductor stocks. The S&P 500 rose 0.4% and the Nasdaq Composite climbed 0.7%, while the Dow Jones Industrial Average slipped less than 0.04%. The session saw all three major indexes briefly turn negative in the afternoon before recovering, underscoring a high degree of investor indecision.

The primary catalysts for the market strength were:

- Strong Bank Earnings: Both Bank of America (BAC) and Morgan Stanley (MS) reported quarterly profits that exceeded analyst expectations, boosting the financial sector.

- AI & Semiconductor Surge: Dutch chipmaking equipment giant ASML Holding (ASML) reported better-than-expected bookings and an optimistic outlook, citing robust demand tied to AI investments. This fueled a significant rally across the semiconductor industry, with Advanced Micro Devices (AMD) soaring 9.4%

- Trade-Related Volatility: President Trump’s threat of an embargo on Chinese cooking oil created volatility, particularly impacting agricultural stocks like Bunge Global (BG), which surged over 13%. Geopolitical tensions were a persistent overhang, contributing to a “flight-to-safety” demand that pushed Gold futures to a new record high above $4,200 an ounce.

Why It Matters?

Today’s trading session highlights a market that is largely ignoring broader macro risks in favor of company-specific fundamental strength. Coming into this week, investors were anxiously awaiting the Consumer Price Index (CPI) report, which was delayed due to the ongoing U.S. government shutdown. This data blackout has removed a critical piece of information for the Federal Reserve and for investors trying to gauge the path of interest rates and inflation.

The fact that strong earnings from the financial and technology sectors were powerful enough to overcome the uncertainty of the government shutdown and rising trade tensions is significant. It suggests that, for now, the narrative of robust corporate profits and the secular growth trend of AI are the dominant forces, giving conviction to institutional investors. This environment of data delay and geopolitical risk is also why Gold is breaking records, as investors seek assets perceived as a safe haven.

The Debate (The Bull vs. Bear Case)

The Bull Case (The Optimistic View): On one hand, optimists believe this week’s earnings are a powerful signal that corporate health remains exceptionally strong and can withstand macro-level headwinds. The strong performance from major financial firms suggests a healthy investment banking environment and solid capital markets. Furthermore, analysts point to the ASML news as evidence that the AI investment cycle is still in its early, explosive phase, driving massive capital expenditure on high-tech hardware. As analysts at Investopedia noted, the “tug-of-war between the corporate earnings and the trade tensions” is currently being won by earnings, suggesting the fundamental profit picture is too compelling to ignore.

The Bear Case (The Cautious View): On the other hand, cautious voices point to the high level of market volatility and the underlying risks being obscured by concentrated gains. A report from BNN Bloomberg noted that the rally remains highly concentrated in a narrow group of technology leaders, with the Magnificent Seven stocks comprising about 34% to 35% of the S&P 500’s weight.

This extreme concentration creates fragility; if any of these large tech names stumble, the entire index could face a sharp correction. Furthermore, the persistent U.S. government shutdown is delaying critical economic reports, creating an “information vacuum” that could lead to an abrupt, negative repricing of assets once the delayed data is finally released. The record high in Gold prices also serves as a warning sign, reflecting long-term concerns over fiscal stability and global uncertainty.

By the Numbers (Key Data & Metrics)

- S&P 500 Close: 6,671.06 (Up 0.4%)

- Nasdaq Composite Close: 22,670.08 (Up 0.7%)

- Dow Jones Industrial Average Close: 46,253.31 (Down <0.1%)

- 10-Year Treasury Yield: 4.04% (Ticked higher, indicating slight caution)

- Gold Futures: Over $4,200/ounce (Set a new record high, up 1.6%)

- ASML Holding (ASML): Up 2.7% (After reporting better-than-expected bookings)

- Advanced Micro Devices (AMD): Up 9.4% (Leading the semiconductor sector rally)

- Bank of America (BAC) & Morgan Stanley (MS): Both up over 4% (Following strong quarterly earnings beats)

Disclaimer: This article is for informational purposes only and does not constitute financial, investment, or legal advice. The information provided is a synthesis of publicly available data and expert analysis and should not be considered a recommendation to buy or sell any security. Investing in the stock market involves risk, including the possible loss of principal. Past performance is not indicative of future results. Readers should consult with a qualified financial advisor to determine an investment strategy that is suitable for their own personal financial situation and risk tolerance.