Summary (TL;DR)

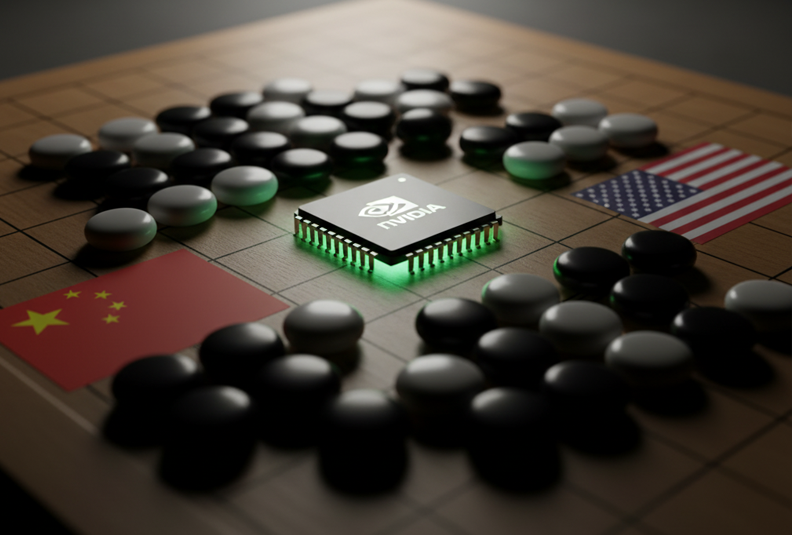

For investors, the key takeaway from the latest NVIDIA news is the direct and escalating impact of U.S.-China geopolitical tensions on the company’s revenue. A new directive from Chinese regulators telling major tech firms to stop buying NVIDIA’s AI chips represents a significant blow to the company’s ability to operate in one of its most important markets. While this news creates immediate headwinds and stock price volatility, it is happening alongside NVIDIA’s continued aggressive expansion and major contract wins in other parts of the world, creating a complex and conflicting picture for the chipmaker’s near-term future.

The Core News (What Happened?)

According to recent reports, China’s internet regulator has instructed the country’s leading technology companies, including giants like Alibaba, Baidu, and Tencent, to halt the purchase of NVIDIA’s advanced artificial intelligence (AI) chips and to cancel any existing orders. This move is a significant escalation in the ongoing “chip war” between the U.S. and China. The news, combined with an ongoing antitrust investigation by Beijing into the company, has put immediate downward pressure on NVIDIA’s stock.

Background (Setting the Stage)

Coming into this period, investors and analysts were focused on how NVIDIA would navigate strict U.S. export controls designed to limit China’s access to advanced technology. In response to initial U.S. restrictions, NVIDIA had developed and begun marketing less powerful versions of its AI chips specifically for the Chinese market. The prevailing expectation was that these compliant chips would allow NVIDIA to preserve a substantial portion of its business in the region. The new directive from Chinese regulators directly undermines that strategy, signaling that Beijing may be rejecting these workarounds and intensifying its push for technological self-reliance.

The Debate (The Bull vs. Bear Case)

This development has sharpened the two competing viewpoints on NVIDIA’s future.

- The Bull Case (The Optimistic View): On one hand, optimists believe that NVIDIA’s global dominance in AI is strong enough to withstand the loss of business from China. Proponents of this view, often cited in market analysis, point to the insatiable demand for AI infrastructure in the U.S., Europe, and other regions. They highlight major positive developments, such as a multi-billion dollar deal with cloud provider CoreWeave and a massive investment to build up the U.K.’s AI capabilities, as proof that NVIDIA’s growth trajectory remains intact and is diversifying away from geopolitical hotspots.

- The Bear Case (The Cautious View): On the other hand, cautious voices point to the material financial impact of this news. China has historically accounted for a significant portion—estimated to be between 20-25% of NVIDIA’s data center revenue. A report from The Wall Street Journal raises concerns that losing this market cannot be easily or quickly replaced, representing a direct hit to the company’s bottom line. This, coupled with the antitrust probe and recent reports of insider stock sales, paints a picture of mounting risk and uncertainty for the stock.

By the Numbers (Key Data & Metrics)

- Premarket Stock Movement: ~1% decrease (This shows the market’s immediate negative reaction to the news from China.)

- China’s Data Center Revenue Share: ~20-25% (Historically, this is the estimated portion of NVIDIA’s key data center business that comes from China, highlighting the scale of the revenue at risk.)

- CoreWeave Cloud Deal: $6.3 billion (This represents a recent major contract win, demonstrating strong demand for NVIDIA’s hardware outside of China.)

Disclaimer: This article is for informational purposes only and does not constitute financial, investment, or legal advice. The information provided is a synthesis of publicly available data and expert analysis and should not be considered a recommendation to buy or sell any security. Investing in the stock market involves risk, including the possible loss of principal. Past performance is not indicative of future results. Readers should consult with a qualified financial advisor to determine an investment strategy that is suitable for their own personal financial situation and risk tolerance.