Morning Market Snapshot – December 4, 2025

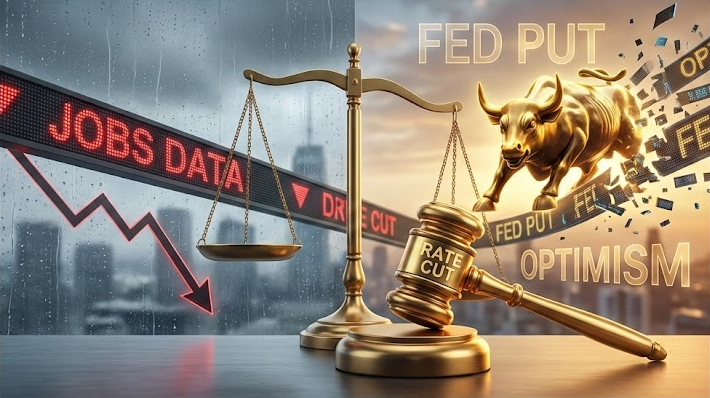

Wall Street is balancing precariously between relief and recessionary anxiety. US stock futures are wobbling but holding onto a fragile optimism following yesterday’s surprising ADP private payroll report, which showed a contraction of 32,000 jobs. In a classic “bad news is good news” reaction, traders have aggressively repriced the probability of a Federal Reserve rate cut later this month to nearly 90%, viewing the labor market weakness as a guarantee of liquidity support.

The immediate focus for the session is the 8:30 AM ET Initial Jobless Claims report. With the “Fed Put” effectively back in play, a higher-than-expected claims number could paradoxically fuel a rally, cementing the case for a December cut. However, the line is thin; if the data suggests a rapid deterioration rather than a controlled cooling, the narrative could quickly shift from “monetary easing” to “hard landing” fears.

Overnight, volatility was muted but directionally mixed. Tech remains a stronghold, buoyed by robust earnings from Salesforce and Marvell Technology, suggesting that enterprise AI spend is shielding the sector from broader economic headwinds. Conversely, the crypto market is flashing warning signs, with Bitcoin struggling under bearish technical signals, potentially indicating risk-off sentiment in speculative assets. Today is a test of the market’s dependency on the Fed: traders are betting the central bank will move fast enough to patch the cracks appearing in the labor market.

Pre-Market News Catalysts

- Dollar General (DG): Shares are active after the discount retailer reported Q3 earnings of $1.28 per share, significantly beating estimates of $0.89. Revenue also topped forecasts at **$10.65 billion**. The beat suggests that while the consumer is stretched, they are consolidating spending into value-oriented staples, a classic defensive signal.

- Salesforce (CRM): The software giant is up roughly 2% in pre-market trading after delivering a “beat-and-raise” quarter. Q3 results exceeded expectations, and the company raised its full-year guidance, citing accelerating demand for its “Agentforce” AI platform. This reinforces the bull thesis that AI monetization is beginning to materialize in software, not just hardware.

- Five Below (FIVE): The teen-focused retailer surged approximately 3.4% in extended trading. It reported a massive earnings beat (adjusted EPS of $0.68 vs. $0.23 forecast) and a 23% jump in revenue to **$1.04 billion**. The results indicate that discretionary spending among younger demographics remains surprisingly resilient despite the macro gloom.

- Marvell Technology (MRVL): The chipmaker is moving higher after posting strong earnings and announcing a strategic acquisition to bolster its custom AI silicon capabilities. This move highlights the ongoing capex super-cycle in the semiconductor space, which continues to be a primary engine for market breadth.

The Day’s Debate (The Bull vs. Bear Case)

The Bull Case: Optimists argue that the “Fed Put” is firmly back in place. With the ADP report showing a shock loss of 32,000 private jobs, the market has priced in a near-certainty (approx. 90%) of a rate cut in December. Sourced experts contend that the Fed has successfully shifted its priority from inflation-fighting to job protection. The resilience of consumer discretionary names like American Eagle Outfitters and Five Below suggests that the “consumer cliff” fears are overblown. Furthermore, the robust guidance from Salesforce and Marvell proves that the AI investment cycle is broadening beyond Nvidia, providing a fundamental floor for the S&P 500 even as the macro data softens.

The Bear Case: Skeptics warn that “bad news is eventually just bad news.” The contraction in private payrolls is not a soft landing signal; it is historically a recessionary red flag. Bearish strategists point to the disconnect between falling labor demand and near-record equity valuations. While tech earnings are holding up, the broader economy is showing cracks. Additionally, the crypto market—often a leading indicator for risk appetite—is flashing a “bear market” signal according to CryptoQuant data, suggesting liquidity conditions may be tighter than equity markets realize. Analysts at Wolfe Research, while positive on Salesforce, lowered their price target, hinting that even the best performers may face valuation compression as growth slows.

The Strategic Takeaway

The single most important dynamic to watch today is the market’s reaction to Initial Jobless Claims at 8:30 AM ET. We are in a window where weak economic data is being celebrated as a precursor to easier money. However, this is a dangerous game. If the jobs data is too weak, the narrative will shift from “rate cuts” to “recession,” and the bid for stocks could evaporate.

For the opening session, ignore the noise and watch the 10-year Treasury yield. If it drops significantly on the jobless data while stocks rise, the “Fed pivot” trade is on. If yields drop and stocks fall, the market is waking up to the growth scare. Position defensively in value (like Dollar General) while keeping exposure to high-quality AI software (like Salesforce) that can outgrow a slowdown.

Upcoming Session Outlook with Directional Bias

Slightly Bullish / Volatile. The bias leans slightly bullish due to the overwhelming expectation of a December rate cut, which puts a floor under prices. However, expect chop at the open as traders digest the jobless claims data; any major deviation from consensus could trigger rapid algorithmic repricing.

Disclaimer: This article is for informational purposes only and does not constitute financial, investment, or legal advice. The information provided is a synthesis of publicly available data and expert analysis and should not be considered a recommendation to buy or sell any security. Investing in the stock market involves risk, including the possible loss of principal. Past performance is not indicative of future results. Readers should consult with a qualified financial advisor to determine an investment strategy that is suitable for their own personal financial situation and risk tolerance.

Sources

- ADP Private Payrolls Data (-32k Jobs)

- Dollar General (DG) Q3 Earnings Results

- Five Below (FIVE) Q3 Earnings Beat

- Salesforce (CRM) Earnings & Guidance

- Marvell Technology (MRVL) Earnings News

- CryptoQuant Bitcoin Bear Signal

- American Eagle (AEO) Earnings Surge

- Market Sentiment & Rate Cut Odds