Morning Market Snapshot – Wednesday, November 5, 2025.

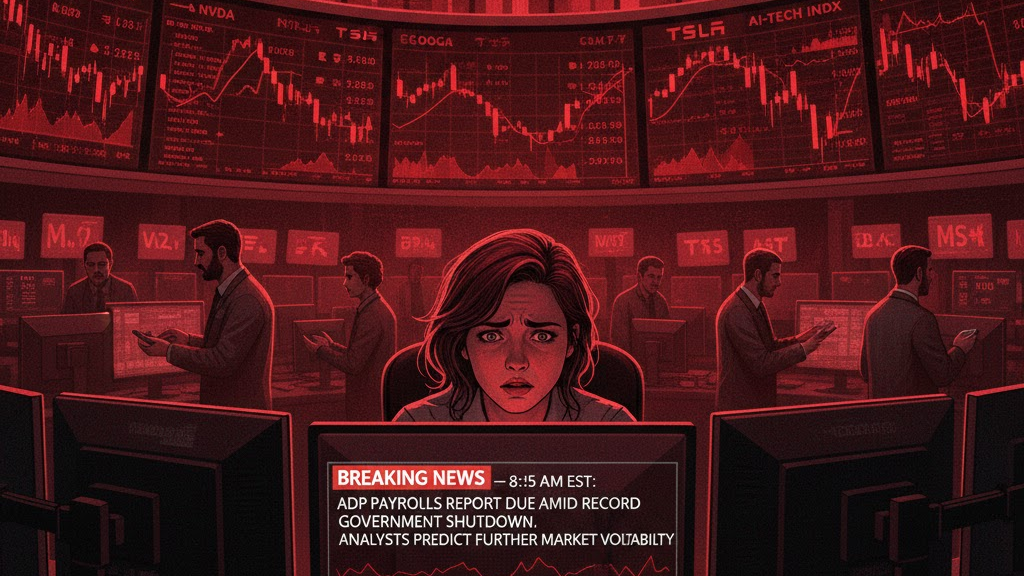

U.S. equity futures are pointing to a lower open this morning, signaling that the tech-led sell-off from the previous session is set to continue. As we approach the opening bell, the market is grappling with a potent combination of fears. The primary driver of the negative sentiment is a growing concern that the long-running artificial intelligence rally has finally tipped over into bubble territory. This anxiety is compounded by a significant macro-political headwind: the federal government shutdown, which began on October 1, has now tied the record for the longest in history at 34 days.

In yesterday’s regular trading, the Nasdaq Composite plunged 2.04% and the S&P 500 fell 1.17%, with high-valuation AI-linked stocks like Palantir leading the decline. That “risk-off” sentiment carried over into overnight trading. Asian markets fell sharply, with chipmakers in Japan and South Korea tumbling, and European indices opened lower across the board. As of 7:20 AM EST, S&P 500 futures are down 0.4% and Nasdaq 100 futures are indicating a drop of 0.6%.

For traders, the focus today pivots entirely to the one piece of major economic data not halted by the shutdown. The ADP private payrolls report is scheduled for release at 8:15 AM EST. This report “takes on added importance” as it provides the only significant window into the U.S. labor market, given that the official Bureau of Labor Statistics jobs report, originally scheduled for this Friday, has been delayed indefinitely by the shutdown. A surprisingly weak number could amplify recession fears, while a strong number might give the Federal Reserve less room to signal future easing.

While local elections in Virginia, New Jersey, and New York City concluded yesterday, the results, including Democrat Zohran Mamdani’s win in the NYC mayoral race, are having little to no impact on the broader market narrative. The market’s attention is fixed firmly on tech valuations and the economic uncertainty radiating from Washington.

Pre-Market News Catalysts

Here are the key individual stocks making significant moves before the bell:

- Advanced Micro Devices (AMD): The chipmaker’s stock is down 3.8% in pre-market trading. This move comes despite the company reporting record third-quarter revenue and profitability after the bell yesterday, beating analyst expectations. The selling pressure is being driven by the company’s forward-looking guidance, which “failed to impress investors” who were looking for a sign of continued explosive growth in the AI sector.

- Rapid7 (RPD): Shares of the cybersecurity firm are trading lower after analysts at Jefferies downgraded the stock to Hold from a previous Buy rating. The downgrade, issued early this morning, also saw the price target lowered to $19.00. Jefferies cited “struggles to execute” relative to its recurring revenue guidance and noted that any potential turnaround would likely be a story for the second half of 2026, not the near future.

- Boise Cascade (BCC): Bucking the negative trend, shares of the building materials manufacturer are up in pre-market action. The positive move was sparked by an upgrade from BMO Capital, which raised its rating on the stock to Outperform. BMO highlighted the company’s “robust” balance sheet and noted that the stock is trading at an attractive valuation of just 4.0 times its mid-cycle EBITDA estimate.

The Day’s Debate (The Bull vs. Bear Case)

The Bear Case: The pessimistic view is dominant this morning. Bears argue that the tech-led sell-off is not just profit-taking but the beginning of a much-needed correction in an overvalued sector. There is a “growing chorus discussing whether we might be on the verge of an equity correction”. This view is supported by widespread “worries over AI bubble”.

Yesterday’s sharp drop in Palantir, followed by AMD’s weak guidance overnight, confirms fears that “the AI rally possibly losing steam”. This sentiment was echoed by chief executives of major U.S. banks, who on Tuesday warned of a potential market correction greater than 10%. This valuation anxiety is dangerously mixed with extreme macroeconomic uncertainty. The ongoing 34-day government shutdown is not a mere political spectacle; it has “halted the flow of key economic data” that policymakers and businesses rely on, effectively blinding the market to the real-time health of the economy.

The Bull Case: The optimistic interpretation is that this is a healthy, and necessary, consolidation rather than a systemic collapse. Bulls argue that underlying corporate fundamentals remain strong, even if forward-looking statements are cautious. They would point to AMD’s actual third-quarter results, which were a “record” for revenue and profitability, as proof that leading companies are still executing at a high level. The current “risk-off” move is seen as a rotation, not an exit.

This pullback is shaking out excessive speculation and creating new opportunities in sectors that have been overlooked. For example, the BMO Capital upgrade of Boise Cascade highlights that value is emerging in non-tech sectors, citing its “robust” balance sheet and attractive valuation. Furthermore, even within the beaten-down tech sector, bulls can find evidence of value. Analysis of Rapid7, despite its downgrade, indicates the company is “profitable with a strong free cash flow yield of 16% and a favorable PEG ratio of 0.27,” which suggests potential undervaluation for long-term investors.

The Strategic Takeaway

The single most important thing to watch this morning is the ADP private payrolls report at 8:15 AM EST. With the government shutdown blinding investors and the Federal Reserve to official labor data, the ADP figure has transformed from a secondary preview into the market’s only high-frequency indicator of economic health. A significant deviation from expectations in either direction could instantly override the pre-market narrative on tech valuations, triggering a highly volatile session.

Upcoming Session Outlook with Directional Bias

Slightly Bearish. The combination of a tech-led overnight sell-off, disappointing guidance from bellwether AMD, and persistent anxiety over a record-long government shutdown has set a negative tone for the open.

Disclaimer: This article is for informational purposes only and does not constitute financial, investment, or legal advice. The information provided is a synthesis of publicly available data and expert analysis and should not be considered a recommendation to buy or sell any security. Investing in the stock market involves risk, including the possible loss of principal. Past performance is not indicative of future results. Readers should consult with a qualified financial advisor to determine an investment strategy that is suitable for their own personal financial situation and risk tolerance.

Sources

- The Guardian

- Investopedia

- Jefferies downgrades Rapid7 stock to Hold on execution concerns By Investing.com

- Boise Cascade stock rating upgraded to Outperform by BMO Capital By Investing.com

- AMD Reports Third Quarter 2025 Financial Results :: Advanced Micro Devices, Inc. (AMD)