Morning Market Snapshot – October 15, 2025

Overnight, global markets saw broad gains as enthusiasm around AI and chipmakers gained fresh momentum, lifting risk appetite across Asia and fueling U.S. futures strength. Strong quarterly reports from major banks added firmness to the rally, even as underlying geopolitical risks and trade tensions with China continue to stir caution.

In Asia, the rally was most pronounced: Japan’s Nikkei advanced ~1.2% on strength in tech and AI names, while Taiwan and South Korea set new highs on semiconductor optimism. Meanwhile, gold surged to fresh records and the U.S. dollar weakened as investors rotated into safer assets.

At the close in New York, the S&P 500 and Nasdaq posted gains as strong bank earnings countered the weight of rising U.S.–China trade tensions.

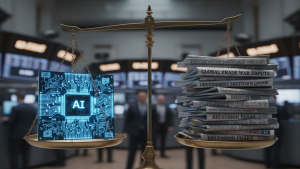

The session is shaping up to be a classic battle between robust micro-level fundamentals and a deteriorating macroeconomic and geopolitical landscape. On one hand, stellar results from key technology bellwethers and major financial institutions are fueling a distinct risk-on sentiment. On the other, the formal confirmation of an active U.S.-China trade war and the continued uncertainty stemming from a U.S. government shutdown are forcing a measure of caution,. This great divergence matters for traders because it creates a fragile optimism; the market’s direction can pivot sharply on the day’s headlines, making it critical to watch whether the powerful earnings narrative can continue to overshadow the persistent macro risks.

Pre-Market News Catalysts

Several U.S. stocks are making significant moves in pre-market trading, driven by company-specific news that is shaping the broader market narrative. The overwhelming theme is the strength of the artificial intelligence investment cycle, which is translating into tangible, market-moving results.

- TSMC boosts sentiment: Taiwan Semiconductor raised its full-year revenue guidance on robust AI demand, sending U.S.-listed shares up and fuelling gains in other chip names like Nvidia and Micron.

- Bank earnings support the rally: Solid results from U.S. banks such as Morgan Stanley and Bank of America reinforced the narrative that core financials are holding up.

- China pushes back over rare earth export controls: Beijing accused the U.S. of stirring global panic over its rare earth export rules, rejecting calls for rollback and intensifying rhetoric in the bilateral trade dispute.

- South Korea signals optimism on U.S. trade deal: A top South Korean government official expressed confidence in impending progress in tariff talks with Washington, helping underpin regional equities.

- Hewlett Packard Enterprise (HPE): On the bearish side, HPE shares tumbled 8% in pre-market trading. The sharp decline followed the company’s decision to cut its long-term guidance, issuing a weaker-than-expected outlook for 2026. This move highlights the market’s sensitivity to forward-looking statements and its willingness to punish perceived weakness.

The Day’s Debate (The Bull vs. Bear Case)

The Bull Case: Corporate Strength and Policy Support Will Prevail

Optimists argue that the tangible strength in corporate earnings, particularly from the technology and financial sectors, provides a firm foundation for further market gains. The primary pillar of this argument is that the AI-driven capital expenditure boom is not just a narrative but a durable growth driver translating into real profits. The blowout results from TSMC, which saw a 40% profit surge on AI chip demand and raised its 2025 revenue outlook to the mid-30% range, serve as Exhibit A. This is corroborated by upbeat outlooks from semiconductor equipment supplier ASML and enterprise software leader Salesforce, reinforcing the view that the “AI Revolution” is accelerating,.

A second key argument for the bulls is the demonstrated resilience of the U.S. financial system. A string of better-than-expected quarterly results from the nation’s largest banks supports the narrative of a potential economic “soft landing”. Morgan Stanley (MS) and Bank of America (BAC) both topped analyst estimates, driven by strong trading and investment banking activity, with their shares rising pre-market. This follows a clean sweep of earnings beats earlier in the week from JPMorgan Chase, Citigroup, Goldman Sachs, and Wells Fargo, suggesting that a core pillar of the economy remains healthy.

Finally, bulls see a supportive policy backdrop forming. The Federal Reserve’s recently released Beige Book pointed to moderating economic growth and soft labor market conditions. This has cemented market expectations for further interest rate cuts, with traders now pricing in at least one more quarter-point reduction this year. This anticipated monetary easing is viewed as a significant tailwind for equity valuations.

The Bear Case: Geopolitical and Macro Risks Are Underpriced

Pessimists contend that the market’s focus on earnings is causing it to ignore a confluence of escalating external risks. The foremost concern is that geopolitical tension has moved from a theoretical risk to a market-moving reality. President Trump has now explicitly confirmed that a “trade war with China is underway”. This follows recent threats of higher tariffs that triggered a sharp sell-off last Friday, a loss from which the major indexes have yet to fully recover. Analysts warn this creates a backdrop of “headline-driven volatility” where “choppy and indecisive conditions are likely to prevail” until a clear resolution on tariffs is reached,.

Compounding this uncertainty is the deteriorating macro data picture, which is being obscured by the ongoing U.S. government shutdown. The shutdown is delaying the release of critical economic reports, including inflation and retail sales data, leaving investors and policymakers to navigate with incomplete information,. The last comprehensive official report, the Fed’s Beige Book, was already showing signs of a slowdown, with nine of the twelve Federal Reserve districts reporting either flat or contracting economic activity. This “data vacuum” is particularly risky because it increases the probability of a policy error by the Federal Reserve, which has explicitly stated its data-dependent stance.

Finally, bears point to stretched valuations as a key vulnerability. After a surge of nearly 35% in the S&P 500 since April, the index is trading at a forward price-to-earnings ratio of around 22-23x, near the top percentile of its historical range,. Critics argue that prices have risen far faster than broad corporate profit growth, leaving the market susceptible to a sharp correction if any of the bullish narratives—particularly around earnings or Fed policy, were to falter.

The Strategic Takeaway

The single most important thing to keep in mind today is that the market is operating with a split personality. The pre-market rally is being driven by a powerful, narrow, and verifiable theme: the AI and technology sectors are delivering exceptional growth. Simultaneously, however, investors are expressing deep-seated anxiety about the broader environment, a fact best illustrated by gold prices hitting a new record high of $4,259 per ounce.

This is not a contradiction; it is a deliberate “geopolitical barbell” strategy. Market participants are simultaneously buying high-growth tech stocks to capture the clear upside from the AI boom while also buying the ultimate safe-haven asset as insurance against a sudden shock from the U.S.-China trade war. This structure means the market is coiled for a potentially large, fast move. The strategic imperative is therefore to respect both narratives. While the momentum is clearly with the bulls this morning, the record-high price of gold serves as a potent reminder of the fragility of the current sentiment and the significant, unpriced risk of a macro-driven reversal.

Upcoming Session Outlook with Directional Bias

Expect a Slightly Bullish tone at the open, as premarket optimism in semiconductors and banks offsets caution over trade and China risks.

Disclaimer: This article is for informational purposes only and does not constitute financial, investment, or legal advice. The information provided is a synthesis of publicly available data and expert analysis and should not be considered a recommendation to buy or sell any security. Investing in the stock market involves risk, including the possible loss of principal. Past performance is not indicative of future results. Readers should consult with a qualified financial advisor to determine an investment strategy that is suitable for their own personal financial situation and risk tolerance.

Sources