Summary

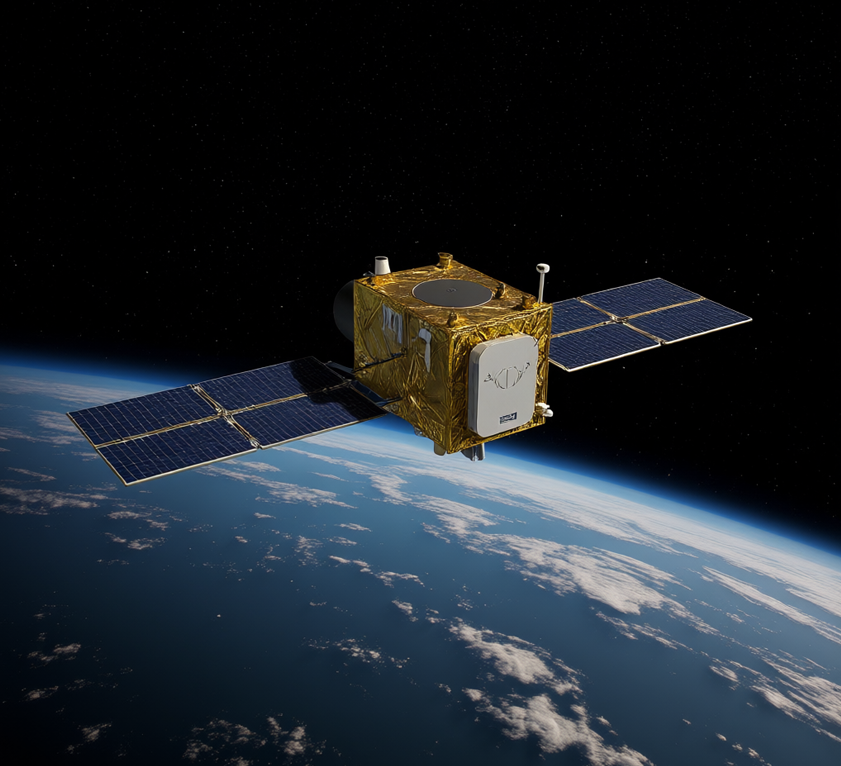

SpaceX, Elon Musk’s aerospace company, has entered into a definitive agreement to acquire crucial wireless spectrum licenses from EchoStar Corp. in a deal valued at approximately $17 billion. For an investor, this news is significant as it marks a pivotal strategic move by SpaceX to vertically integrate and accelerate its global “direct-to-cell” satellite communications service, potentially disrupting the traditional telecommunications industry. By securing its own licensed spectrum, SpaceX’s Starlink division can move beyond reliance on partnerships with mobile carriers, aiming to eliminate mobile dead zones worldwide. The deal also serves as a financial lifeline for EchoStar, resolving significant regulatory pressure and addressing its substantial debt load, fundamentally altering its future business model from a potential network competitor to a service provider leveraging partners’ infrastructure.

The Core News (What Happened?)

On Monday, September 8, 2025, EchoStar announced it would sell its entire portfolio of AWS-4 and H-block spectrum licenses to SpaceX. The transaction is valued at roughly $17 billion, composed of up to $8.5 billion in cash and up to $8.5 billion in SpaceX stock. As part of the agreement, SpaceX will also fund approximately $2 billion in cash interest payments on EchoStar’s debt through November 2027. This acquisition is intended to provide the foundational airwaves for SpaceX to deploy a next-generation Starlink constellation capable of delivering direct-to-cell phone services. Concurrently, the companies will enter a long-term commercial agreement allowing EchoStar’s Boost Mobile subscribers to access this future Starlink service.

Context & Expectations

Leading up to this announcement, EchoStar was in a precarious financial and regulatory position. The company faced immense pressure from the Federal Communications Commission (FCC), which had launched an inquiry in May 2025 into whether EchoStar was meeting its 5G network build-out requirements and properly utilizing its spectrum assets. Accusations of “spectrum squatting” created significant uncertainty, with the FCC threatening to revoke the company’s valuable licenses. This regulatory overhang, coupled with a substantial debt burden and missed interest payments, made it clear to the market that EchoStar needed to monetize its assets. The company had already agreed to sell a different set of spectrum licenses to AT&T for $23 billion in August 2025. This second major sale to SpaceX was therefore a direct consequence of this pressure, largely meeting expectations that EchoStar would be forced to divest its primary spectrum holdings to resolve its regulatory and financial crises.

Potential Implications (The Bull vs. Bear Case)

This landmark deal presents a spectrum of potential outcomes for the companies involved and the broader telecommunications sector.

Bull Case: Analysts see this as a strategic masterstroke for SpaceX. “Owning its own spectrum will allow the company to roll out services more quickly and on its own terms,” according to a report from Drive Tesla Canada, liberating Starlink from depending on partners like T-Mobile. By acquiring this “golden band” for direct-to-cell services, SpaceX not only secures critical infrastructure for its mission to end mobile dead zones but also eliminates EchoStar as a potential competitor in the satellite-to-phone market. For EchoStar, the bull case is one of survival and reinvention; the combined $40 billion in spectrum sales to AT&T and SpaceX resolves the threatening FCC inquiry and provides the capital to pay down significant debt. As noted by TD Cowen analysts, who subsequently raised their price target on EchoStar, the deal unlocks the value of its assets and vastly improves its financial position.

Bear Case: Conversely, some experts highlight significant hurdles. A key concern, raised by TMF Associates founder Tim Farrar, is that the AWS-4 and H-block spectrum acquired by SpaceX “is not supported by any current phones.” This creates a major dependency on device manufacturers like Apple to incorporate the necessary hardware into future smartphones. This could mean a multi-year delay before a widespread consumer base can access the service, as people are holding onto their phones longer. Furthermore, analysts at BNP Paribas Securities expressed skepticism about Starlink becoming a full-fledged fourth national wireless carrier, noting that if this were the goal, SpaceX could have also acquired EchoStar’s 25,000 terrestrial towers, which are instead being decommissioned. The deal also negatively impacts competitors like AST SpaceMobile, whose shares fell over 9% following the news, as SpaceX now possesses a significant first-mover advantage with dedicated spectrum.

Key Data & Metrics

- Total Deal Value: Approximately $17 billion.

- Payment Structure: Up to $8.5 billion in cash and up to $8.5 billion in SpaceX stock.

- Debt Coverage: SpaceX will fund ~$2 billion of EchoStar’s debt interest payments through November 2027.

- Acquired Assets: All of EchoStar’s AWS-4 and H-block spectrum licenses.

- Market Reaction: EchoStar (SATS) shares surged as much as 26% on the day of the announcement.

- Starlink Network Size: Over 7 million customers in more than 150 countries.

Disclaimer: This article is for informational purposes only and does not constitute financial, investment, or legal advice. The information provided is a synthesis of publicly available data and expert analysis and should not be considered a recommendation to buy or sell any security. Investing in the stock market involves risk, including the possible loss of principal. Past performance is not indicative of future results. Readers should consult with a qualified financial advisor to determine an investment strategy that is suitable for their own personal financial situation and risk tolerance.