Summary (TL;DR)

For investors, the key takeaway from this week’s news is that Tesla shareholders have overwhelmingly bet on Elon Musk, and only Elon Musk, to lead the company into its next era. By approving a new, potentially trillion-dollar pay package, shareholders (with over 75% in favor) have signaled they believe Musk’s ambitious vision for artificial intelligence and robotics is worth an unprecedented gamble. This vote aims to secure his focus on Tesla for the next decade, tying his compensation to hitting massive, world-changing targets.

This development is significant because it directly impacts the two biggest questions for Tesla: leadership and future direction. The move attempts to solve the risk of Musk dedicating his time to his other companies, like xAI or SpaceX. However, it also amplifies the “key-man risk,” linking Tesla’s fate more tightly than ever to one individual, while sidelining vocal critics who point to recent declining sales and governance concerns.

The Core News (What Happened?)

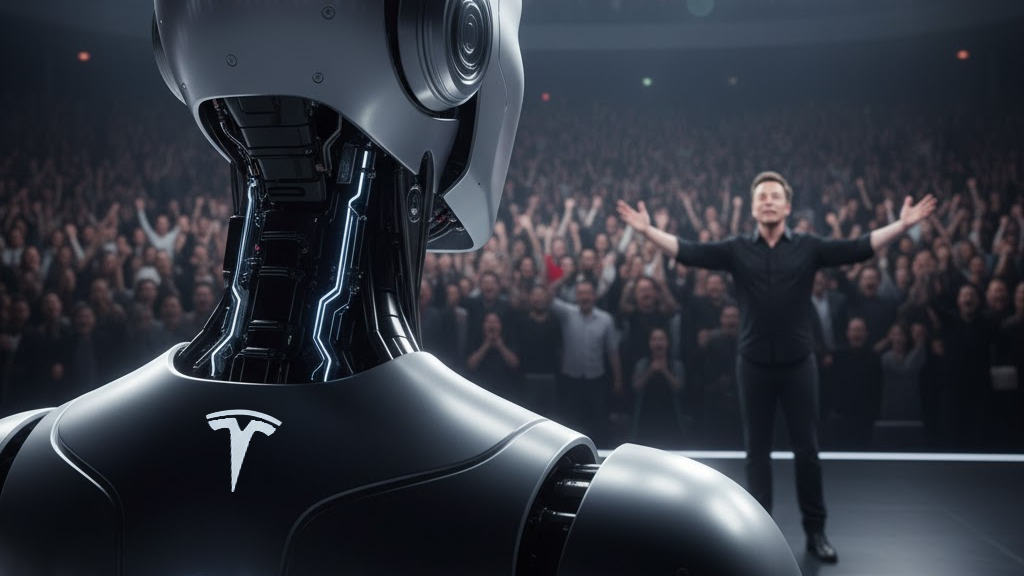

At Tesla’s annual shareholder meeting on Thursday, November 6, 2025, investors voted to approve a new 10-year compensation plan for CEO Elon Musk. This package, which could be worth up to $1 trillion if all targets are met, is the largest in corporate history.

It is not a guaranteed salary. Instead, it’s a series of 12 stock option grants that Musk only receives if he meets a list of incredibly difficult performance goals. Separately, shareholders also voted to re-approve his 2018 pay package (valued around $56 billion), which a Delaware court had previously voided.

Background (Setting the Stage)

Coming into this week, this vote was highly contentious. Tesla’s board had argued the package was essential to “retain and incentivize” Musk, ensuring he remains focused on Tesla’s pivot from an electric vehicle maker to an “AI and robotics” company.

Investors and analysts were divided. On one side, several major institutional investors and advisory firms, including Norges Bank (Norway’s sovereign wealth fund), Institutional Shareholder Services (ISS), and Glass Lewis, had publicly recommended voting against the package, citing its excessive size and concerns over corporate governance. This opposition was fueled by a difficult year for Tesla, which has seen declining sales and profits, with some (like a recent Yale study) blaming Musk’s political activities for alienating customers.

The Debate (The Bull vs. Bear Case)

This vote brings the two competing stories about Tesla into sharp focus.

The Bull Case (The Optimistic View): On one hand, optimists believe this move was absolutely necessary. Proponents, like analyst Dan Ives of Wedbush Securities, framed the “yes” vote as essential to ensuring Musk remains dedicated to Tesla. The 75%+ approval is seen as a “resounding victory” and a massive vote of confidence from the shareholder base, which believes Musk is a unique “genius” capable of achieving the plan’s lofty goals. They argue that by tying his pay to a potential $8.5 trillion valuation, the plan perfectly aligns his incentives with creating massive value for all other shareholders.

The Bear Case (The Cautious View): On the other hand, cautious voices point to this as a failure of corporate oversight. Critics like the protest group Tesla Takedown called the package a “$1tn for failure” and the “world’s most expensive participation trophy,” given the company’s recent drop in sales. Corporate governance experts, such as Nell Minow of ValueEdge Advisors, raised concerns that the plan’s wording might still give the board discretion to award shares even if the ambitious goals aren’t fully met. Others, including New York State Comptroller Thomas DiNapoli, called the package “pay for unchecked power, not pay for performance.”

By the Numbers (Key Data & Metrics)

- Shareholder Approval: More than 75% of voting shareholders approved the plan.

- Potential Max Value: Up to $1 trillion over 10 years.

- Structure: 12 separate tranches of stock options that vest (are earned) as goals are met.

- Goal 1 (Market Cap): Increase Tesla’s market capitalization (the total value of all its shares) from its current ~$1.5 trillion to $8.5 trillion.

- Goal 2 (Vehicle Delivery): Deliver a cumulative 20 million vehicles over the 10-year period.

- Goal 3 (Robotics): Sell 1 million “Optimus” humanoid robots.

- Goal 4 (Autonomous): Deploy 1 million robotaxis and achieve 10 million Full Self-Driving (FSD) subscriptions.

- Goal 5 (Profit): Reach $400 billion in annual Adjusted EBITDA (a measure of core profit before interest, taxes, and other accounting items) for four straight quarters. For context, Tesla’s peak was $19 billion in 2022.

- Musk’s Potential Stake: If all goals are met, Musk’s ownership stake in Tesla could grow from ~15% to 25%.

Disclaimer: This article is for informational purposes only and does not constitute financial, investment, or legal advice. The information provided is a synthesis of publicly available data and expert analysis and should not be considered a recommendation to buy or sell any security. Investing in the stock market involves risk, including the possible loss of principal. Past performance is not indicative of future results. Readers should consult with a qualified financial advisor to determine an investment strategy that is suitable for their own personal financial situation and risk tolerance.

Sources: