Summary (TL;DR)

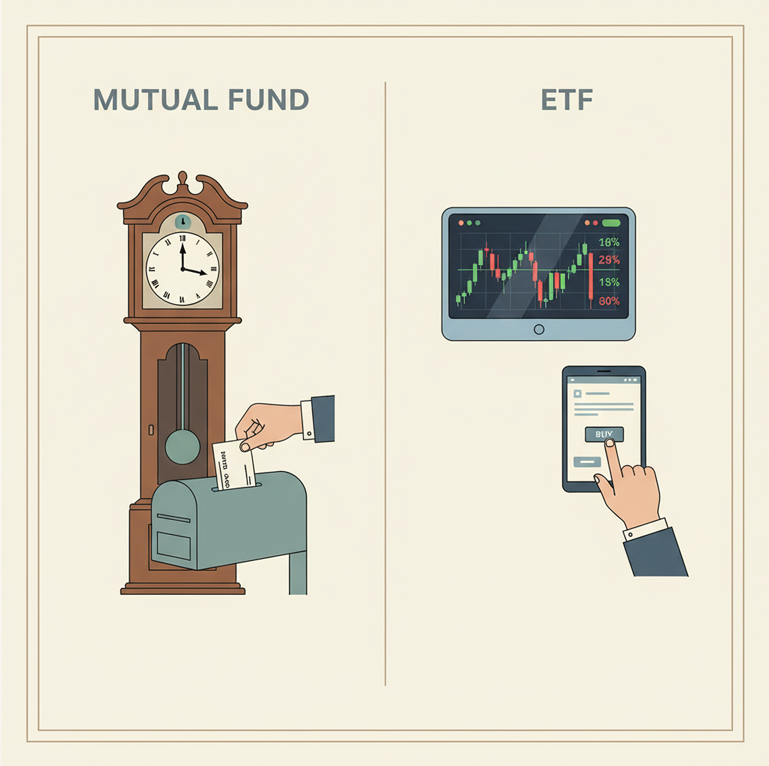

Mutual Funds are like a single, large cake you can only buy or sell once a day, with a price set after the market closes. ETFs are like pre-packaged snack boxes you can buy and sell at any time during the day, with a price that changes constantly. Both let you own a small piece of many different investments, but they work in different ways.

Introduction

Embarking on the journey of investing, one quickly learns that owning a single company’s stock is not the only path. For many, the wiser and more common approach is to own a small piece of a great many companies at once. This is the world of funds, and two dominant forces rule this landscape: Mutual Funds and Exchange-Traded Funds (ETFs). While they share the goal of diversification, their very nature—how they are bought, sold, and priced—is where their paths diverge, creating a crucial distinction for every new investor to understand.

A Look Back in Time

The concept of pooled investing began to take shape in the 19th century, but the mutual fund as we know it today was pioneered in Boston in the 1920s. They were revolutionary, making professional money management and broad diversification accessible to the average person for the first time. The ETF, on the other hand, is a much more modern invention, born from the technological advancements of the 1990s. The first U.S. ETF, the SPDR S&P 500 (SPY), was created in 1993, offering a way for investors to trade an entire stock index as if it were a single stock.

The Core Concept (Explained with Analogy)

Imagine you and your friends want to have a group lunch.

A Mutual Fund is like a fancy, coordinated potluck dinner. The host (the fund manager) tells everyone what to bring (stocks, bonds, etc.), and you give your contribution (money) to them. At the end of the day, after all the food has arrived, the host calculates the value of the entire meal and tells you how much your share is worth. You can’t join or leave the potluck in the middle of the day; you can only buy in or cash out your share at the official closing price once everyone has finished their preparations.

An ETF is like a pre-made lunch box sold in a bustling marketplace (the stock exchange). Each box contains a specific recipe of items (e.g., a sandwich, an apple, and some chips). The price of the box can go up or down throughout the day depending on how popular it is, just like the price of a single apple or chip might change. You can buy or sell this lunch box at any time the market is open, at the current market price, and the transaction is instant.

A Real-World Connection

The rise of index funds beautifully illustrates the difference. In 1976, Vanguard’s founder, John Bogle, created the first index mutual fund available to the public. It was a simple, low-cost way to own a tiny slice of every company in the S&P 500. Decades later, the launch of the SPDR S&P 500 ETF (SPY) took this idea of index investing and made it instantly tradable, fueling a new era of market access for investors around the world.

From Theory to Practice

For the investor, the choice between these two funds often comes down to a few key questions:

- “How often do I want to trade?” If you want the ability to buy or sell at any moment during the trading day, an ETF is the only option. If you are a long-term investor who only buys once a month, a mutual fund’s once-a-day pricing may be perfectly fine.

- “How much will this cost me?” Both funds have fees, known as expense ratios. Mutual funds can sometimes have additional fees to buy or sell (called loads), while ETFs are bought and sold just like a stock, so you pay a trading commission to your broker.

- “Do I want an actively managed or passively managed fund?” Mutual funds can be actively managed, where a professional picks stocks to try and beat the market, or passively managed, where they just track an index. Most ETFs are passively managed, making them a simple and often low-cost option.

A Brief Illustration

Let’s say you have $100 to invest in a fund that tracks a hypothetical “Tech 10” index.

- Mutual Fund: You place a $100 order with the fund company at 11:00 AM. At 4:00 PM, the market closes. The fund manager calculates the Net Asset Value (NAV) of all the stocks in the fund. Let’s say the NAV is $20. Your order is filled at this price, and you receive 5 shares ($100 / $20 = 5).

- ETF: You log into your brokerage account at 11:00 AM. The current price of the “Tech 10” ETF is $19.98. You place a market order to buy 5 shares. The order is filled instantly at the price of $19.98, costing you $99.90 (plus any brokerage commission).

The Chapter’s Wisdom (Key Takeaways)

- Trading Time: Mutual Funds trade once a day, after the market closes. ETFs trade all day long, just like a stock.

- Pricing: A Mutual Fund’s price is set by its Net Asset Value (NAV) at the end of the day. An ETF’s price fluctuates throughout the day based on supply and demand.

- Cost: Both have expense ratios. Mutual Funds may have additional “load” fees, while ETFs have brokerage commissions to buy and sell.

- Access: Mutual Funds are bought directly from the fund company. ETFs are bought on a stock exchange through a brokerage.

Chapter Glossary

- Mutual Fund: A professionally managed investment fund that pools money from many investors to purchase securities.

- Exchange-Traded Fund (ETF): A type of fund that holds a basket of assets and is traded on a stock exchange.

- Net Asset Value (NAV): The value of a single share of a mutual fund, calculated by dividing the total value of the fund’s assets by the number of shares.

- Expense Ratio: The annual fee a fund charges as a percentage of your investment.

Food for Thought (Engagement Prompt)

Given the distinction, for a person who wants to invest for the very long term (over 20 years), which fund type do you think would be the better fit and why? Are the differences in trading time or price fluctuation as important for this kind of investor?

Content Integration Hooks

- Chapter on Active vs. Passive Management: Dive deeper into the role of the fund manager and the debate over trying to beat the market.

- Guide to Understanding Expense Ratios: Explain in detail what an expense ratio is and how it can impact long-term returns.

- The Rise of Index Investing: Tell the story of how index funds became a powerful force in the financial world.

Additional Topics to Explore

- ETFs: The Investment Basket: Understanding Exchange-Traded Funds (ETFs)

- Slippage: The specific problem that the stop-limit order is designed to solve.

- Understanding Support and Resistance: The Market’s Memory: Understanding Support and Resistance